Panoramic Weekly: Brexit, May be yes, maybe not

After more than two years of bitter discussions, leadership battles, thousands of hours and millions of pounds spent on a divorce agreement between Britain and the EU, sterling barely blinked when a draft deal was finally struck. Investors held off in an uncertain environment, only to move quickly when further uncertainty unfolded: the pound sold off and gilts rallied after two cabinet ministers quit, raising speculation of a leadership challenge and a potential general election. A weaker currency fuelled inflation expectations, with the five-year breakeven rate spiking 3.9%, the biggest jump since 2015. As gilts, German and French sovereign bond yields dropped on safe-haven demand, while Italy, Spain, Portugal and Greece saw their borrowing costs nudge higher.

Either caused by Brexit or by the ongoing China-US trade friction, the backlash on global trade is beginning to bite: the German economy shrank by 0.2% in the third quarter, the first in three years, while Japan’s contracted 1.2% over the same period. China published hot-and-cold October data, while October US inflation and the latest loan demand data came in slightly soft. OPEC’s warning of weakening oil demand sent crude prices tanking for a record 12 days in a row (more below). Traditional safe-haven assets, such as US Treasuries, the yen and the US dollar, outperformed.

Heading up:

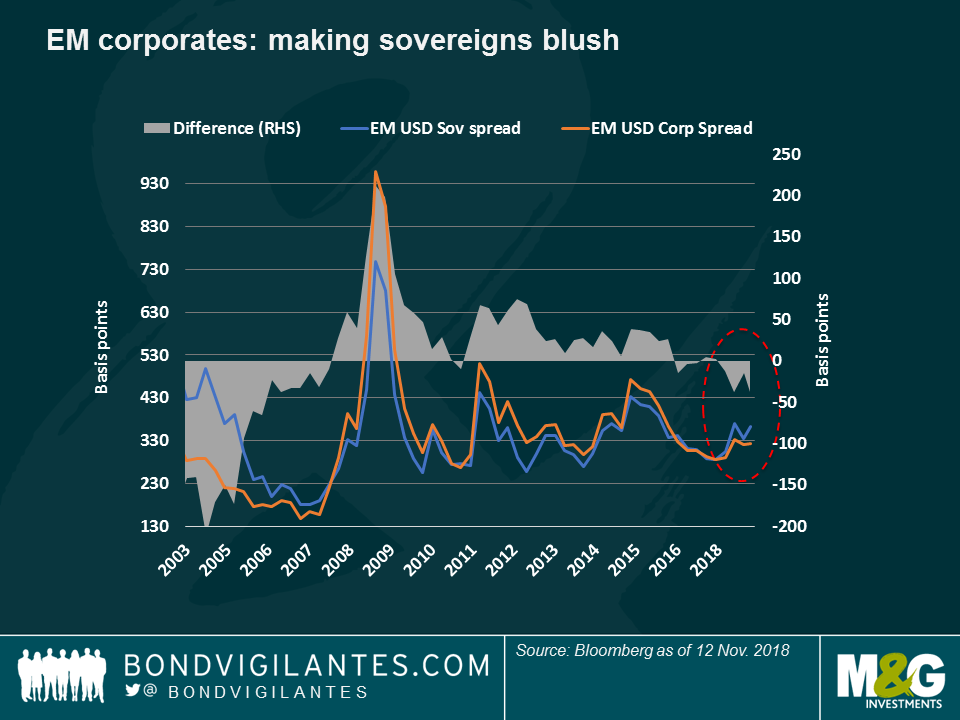

Emerging Market (EM) Companies – more trustworthy than governments? The premium that investors are paid to hold EM corporate over EM sovereign debt has, traditionally been high as governments tend to have a better reputation with creditors. Not only has this fallen but it has reversed: as seen in the chart, EM corporate spreads now trade inside EM sovereigns’, reaching a gap of 37 basis points, the highest since 2006 – when leading corporate indices were mostly dominated by state-controlled firms that were perceived as relatively safe. The financial crisis brought sovereigns back into the less risky camp, as most EMs didn’t have to incur costly bank rescues. This situation continued until earlier this year, especially in the summer, when the crisis in Turkey and Argentina spread to other EM sovereigns. Corporate spreads, on the contrary, have not risen as much, underpinned by the outperformance of Asian firms, China’s well-stimulated economy and, of recent, also on hopes that December’s US-China summit may deliver a trade truce, helping the region’s exporters. This week’s collapse in oil prices is also good news for oil-importing Asia. Over the past five trading days, the top 20 (of 100) Fixed Income asset classes tracked by Panoramic Weekly included as many as 8 different Asian corporate indices.

New Zealand – up and above: After decades of being boxed as “down under,” at least New Zealand bond holders may now claim the opposite: the country’s corporate and sovereign debt have both outperformed a list of 98 other Fixed Income asset classes over the past 30 days on the back of a strong economy and contained interest rates: the jobless rate unexpectedly dropped to a 10-year low in the third quarter, while the central bank left rates unchanged last week. The kiwi dollar is the best-performing G10 currency against the US dollar so far in November, up 4.3%, and cutting down its year-to-date loss against a rising greenback to 4.2%.

Heading down:

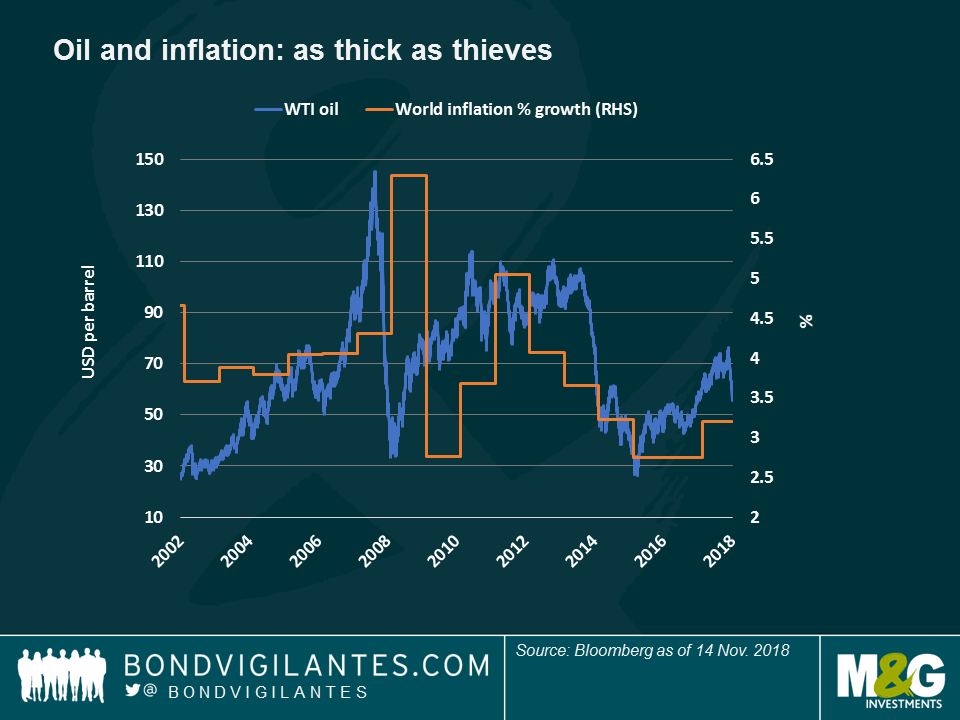

Oil – crude times: Generally a reflection of the global economy’s heartbeat, oil prices sank to $56 per barrel, down from $76 last month, after OPEC’s latest monthly report showed increased Saudi Arabia supply and reduced demand forecasts. Leading institutions such as the IMF have cut their global growth forecasts this year, citing lower momentum in Europe and Asia, the negative effect of trade wars and prospects of rising rates after a decade of loose monetary policy. Some investors also question the sustainability of the US strong economic streak once the effects of the recent corporate tax cuts wane. US corporates suffered from the oil collapse, as credit spreads of oil-heavy indices, such as US Investment Grade and High Yield (Energy accounts for about 15% of both), widened. On the other hand, currencies of oil importing countries, such as Turkey and India, surged against a rising dollar. Those of oil exporting nations, such as Mexico, Brazil and Russia, have lost between 1.25% and 2.25% so far this month. Lower oil prices, though, are generally perceived as positive as inflation expectations, and interest rate forecasts, drop. As seen in the chart, inflation and oil are strongly linked.

Mexico – not flying: Mexican government bonds were the worst-performing Fixed Income asset class among the 100 tracked by Panoramic Weekly, down 4.1% over the past five trading days and 11% over the past 1 month period. Once excited about Lopez Obrador’s prospects as new president, investors now seem to be losing faith: his decision to cancel a $13 bn new airport, when one third is already complete, has not been welcomed, while his proposal to call referendums on the construction of a refinery and a tourist train have raised uncertainty. Also expecting higher future interest rates, investors seem to have grounded bonos for now.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox