Panoramic Weekly: Exhausted, confused after roller-coaster week

Despite big headlines and price swings, most fixed income asset classes ended the five-day period back where they started. This moderate, short-term mean-reversion reflects contradictory views and general confusion over the outcome of the US-China trade negotiations, Europe’s national deficits and Brexit. The world-benchmark 10-year Treasury yield has reflected this mood, dropping to 2.85%, down from 3% earlier this month, just as the US Federal Reserve (Fed) insists on a solid domestic economy and further rate hikes, and all while High Yield spreads have widened by more than 100 basis points since October. For more insight, don’t miss M&G’s Jim Leaviss annual outlook “Panopanic 2018,” and Laura Frost’s recent video: “Market contradictions.”

Heading up:

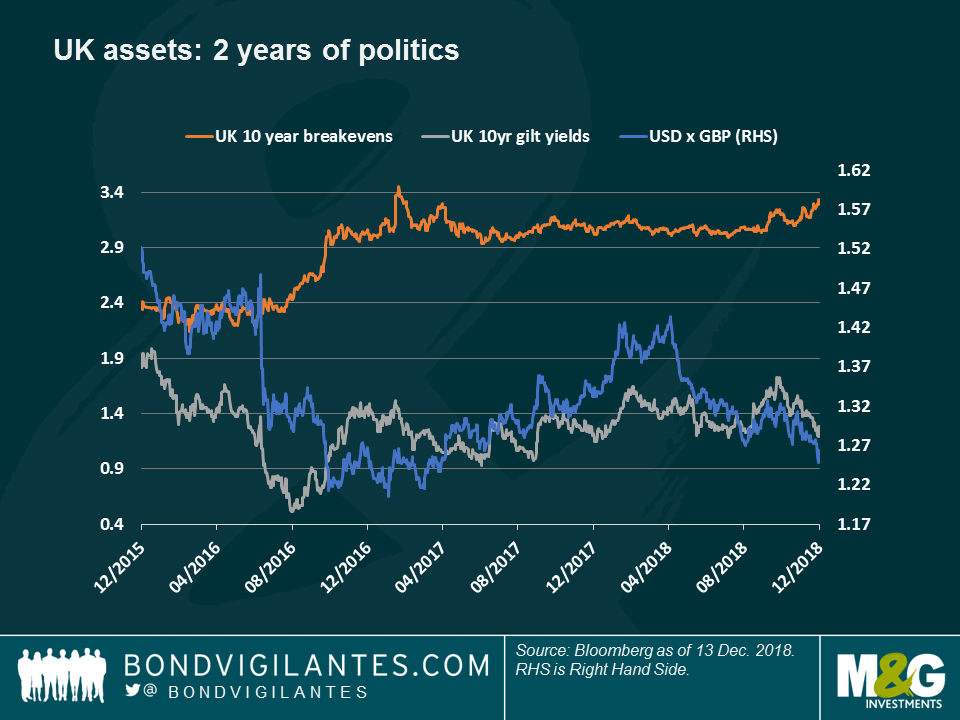

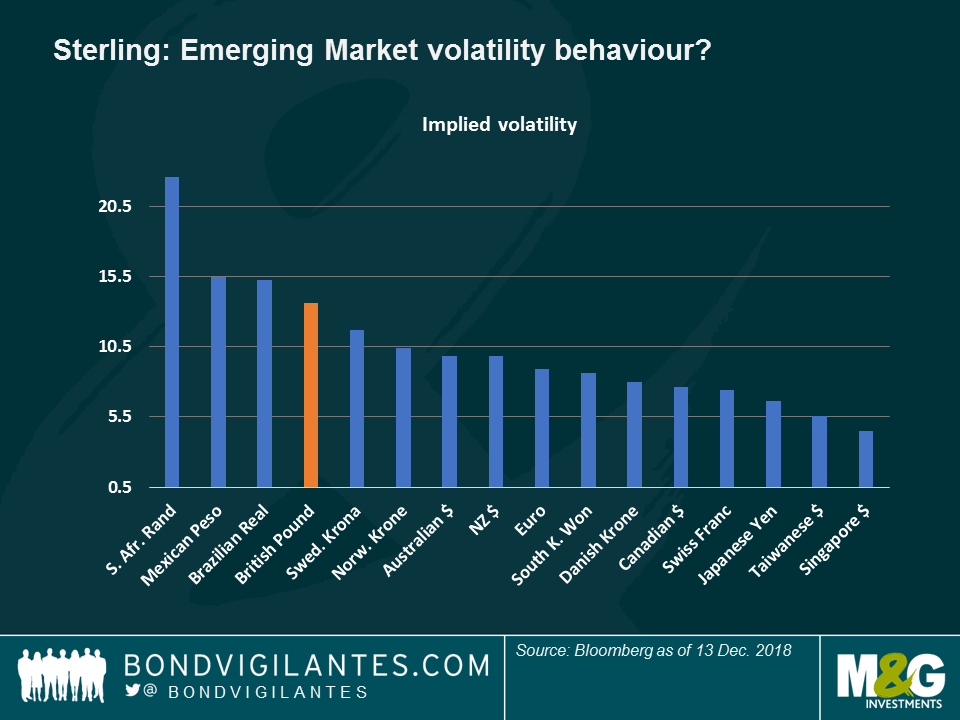

UK assets – Winter in Wonderland: UK gilts and breakeven rates, as well as sterling, have had a Winter in Wonderland-like roller-coaster ride in December that has left them barely where they were: back to square one. After two years of negotiations, and against some odds, UK Prime Minister Theresa May will spend Christmas at No. 10 Downing Street, having survived numerous challenges, including Wednesday’s Leadership contest from her own party. In reaction, the pound strengthened, and gilt yields rallied, both on market expectations that a disorderly exit from the EU is now less likely. Ten-year inflation expectations, which had spiked to an 18-month high of 3.3% just before the Leadership challenge, waned slightly. However, they are still running high (orange line in the chart) as a departure of the EU is expected to weaken the pound, making imports more expensive. Sterling volatility may not have quieter days ahead, either: as seen in the second chart, the British currency ranks before South Africa, Mexico and Brazil in terms of volatility, yet while offering a much lower carry: ten-year UK sovereign bonds yield 1.25% at present, below Brazil’s 5.1% and Mexico’s 4.6% (for 9-year bonds). As M&G fund manager Ben Lord recently said, Britain’s MP’s Christmas may be not be that quiet.

French spreads – shiny heights: The premium that investors demand to hold French government bonds over traditionally rock-solid German bunds spiked to 44 basis points earlier this week, the highest since last year’s national election, when fears of a far right-wing, Eurosceptic victory were running high. The recent spike followed riots in Paris, and across France, in which worker’s protests led President Macron to promise a higher minimum wage and to cut some taxes. Investors, though, were quick to reprice their premium on French debt as the country’s Budget Deficit is expected to spike to 3.4% of GDP, up from a previous estimate of 2.8% – dwarfing Italy’s expected 2% figure. Brussels may be a bigger challenge for Macron.

Heading down:

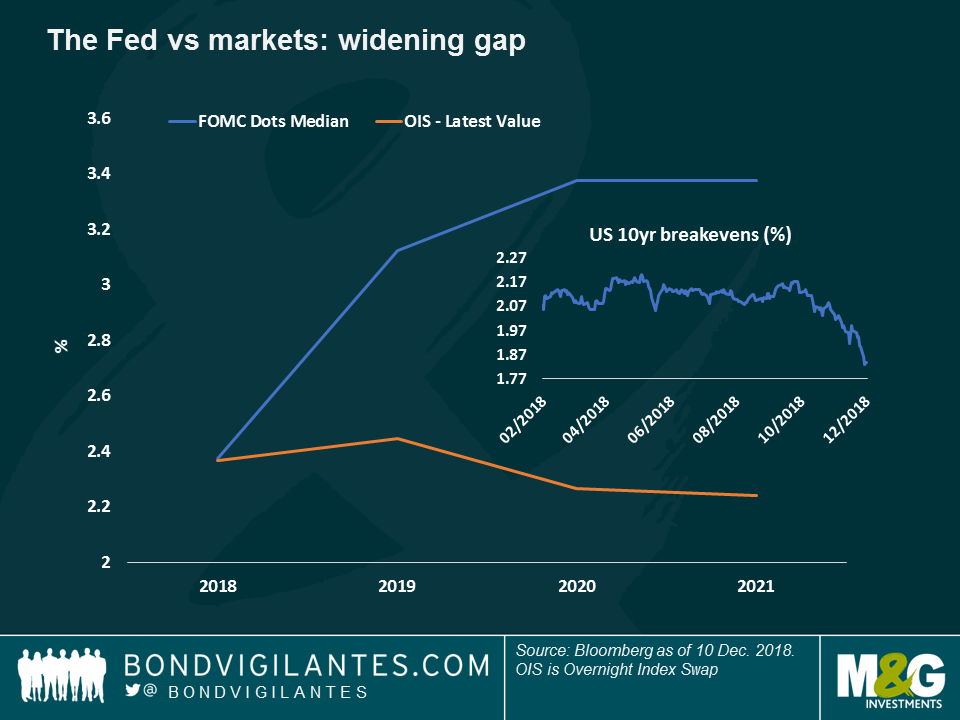

The Fed vs the markets – parting ways: The discrepancy about interest rate expectations between the Fed and the markets is only getting wider: while Fed officials see rates at 3.5% in 2021, the market-implied probability points to a much lower 2.5%, just one quarter-point rate hike above the present level. While Fed officials have sounded more dovish of late, their stance continues to be one of solid growth (2.9% this year), set to continue over the next two years, albeit at a slower pace (2.6% this year and 1.9% in 2020). Instead, markets seem to be more focused on inflation expectations, a key driver of Fed policy, especially since unemployment, at a 50-year low, is not a top worry. Inflation expectations, though, have plunged in the third quarter, down from 2.17% in early October to the present 1.83%, the lowest in more than one year. The plunge in oil prices has directly contributed to this drop, widening the wedge between Fed and market expectations. But it’s not all down to oil: investors are also questioning corporate earnings after the effect of this year’s tax cuts wane, at the same time that next year’s profit forecasts have been largely cut. The IMF has also reduced its global growth estimate, citing the ongoing trade wars. Over the past few years, markets’ predictions have tended to be more accurate than the Fed’s but, as ever, past performance is not an indicator of future outcomes.

India – high turnover at the central bank: The Indian rupee plunged 2.1% over the past five trading days, the worst Emerging Market (EM) currency performance against the US dollar, following Wednesday’s abrupt departure of central bank governor Urjit Patel. The appointment of Shaktikanta Das, the third central bank chief in as many years, has raised investors’ questions about the monetary authority’s independence, especially ahead of next year’s general election. The new chief, though, is expected to cut rates as inflation has slowed down to an annualised 2.3%, at the same time that India bears the highest real rates in Asia, at 4.2%, hindering growth.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox