Tourism drop in CEE and CIS – many losers but also some beneficiaries?

Summer has arrived, and so should the main tourist season in Europe in a normal year. However, as we know, this year has been anything but normal. With lockdown endings in sight across the majority of countries in the region, most are preparing to welcome tourists back. Some have already opened their borders for EU visitors, while many prepare to open them for everyone from late June or early July. When and whether tourists actually return though is quite another question. Despite the removal of travel restrictions, many people will likely still limit their travel due to safety concerns and significant drop in their incomes.

Some of the first hard data since the beginning of the pandemic have not been encouraging – for example, Turkey has reported 99% y/y drop in foreign tourist arrivals in April. On a positive note, for the vast majority of European countries, the highest share of tourist revenues tends to come in Q3 (up to 50-60% of the annual total). Consequently, in theory there is still some time partly to make up for the losses in April-June, provided willingness to travel recovers.

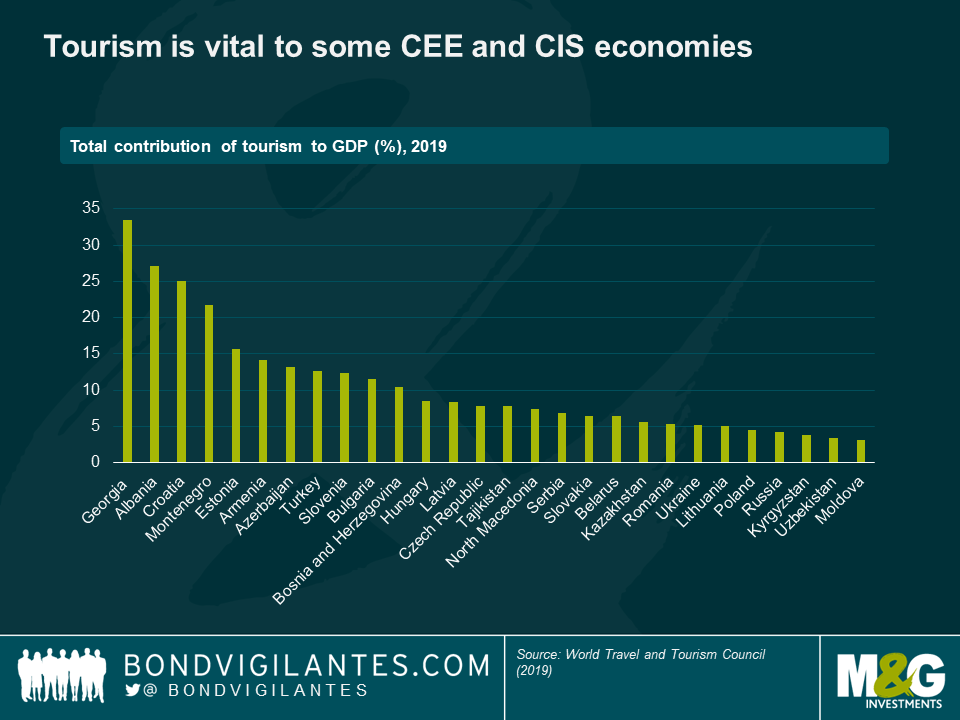

The tourism industry is important for many European countries, including developed ones – with Iceland, Cyprus and Greece topping the ranks in terms of the contribution of tourism to GDP. However, it is even more vital for some CEE (Central and Eastern Europe) and CIS (Commonwealth of Independent States)* economies.

*Armenia, Azerbaijan, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, and Uzbekistan.

Georgia is by far the most affected country in the region. According to World Travel and Tourism Council, the total (direct and indirect) contribution of tourism to its GDP more than doubled this decade, reaching 34% in 2019. In its May report, the IMF forecasts a two-third drop in foreign tourist revenues in Georgia this year. The corresponding negative impact on GDP growth may not be as catastrophic as these numbers seem to suggest (as some labour and capital unused in the tourism industry could be reallocated to other industries), but it will still be very notable. Some small economies on the Adriatic coast (Albania, Croatia, Montenegro) come next in terms of relative vulnerability in the region. In Albania’s case, the need to reconstruct infrastructure following the devastating earthquake in November will likely mean an even deeper drop in tourism this year. Importantly, tourism-dependent economies also tend to have a relatively low share of manufacturing exports in their GDP, which could limit their economic recovery even when growth in developed Europe starts picking up.

Can an EM country actually benefit from widespread travel restrictions and people’s unwillingness to travel far? Somewhat paradoxically, the answer may be yes for a couple of countries in the CEE and CIS region. For example, in Ukraine, outbound tourism expenditures (i.e. by Ukrainian residents abroad) tend to exceed significantly the receipts from foreign tourist arrivals. According to the World Tourism Organisation, this difference has been as much as 5% of GDP in recent years, despite Ukraine being one of the poorest countries in Europe. A similar situation to a lesser magnitude can be observed in some other countries as well, including Uzbekistan, Armenia, Romania and Russia. A note of caution though – the data on outbound tourism is collated using the information supplied by the destination countries and has its limitations. In particular, it might be somewhat distorted by migrant workers, which could be true for Uzbekistan, Armenia and partially Ukraine, as well as some others. The Russian case may also seem a bit surprising given the abundance of history and natural beauty, but it probably just demonstrates that infrastructure development and other factors such as the visa process tend to matter more for tourism inflows.

It is clear that, due to the significance of outbound tourism, some countries are unlikely to suffer much from travel restrictions and lower willingness to travel. And in some, this could even exert a positive influence, at least on the balance of payments and exchange rate dynamics. For example, the National Bank of Ukraine estimates that outbound tourism could drop by about half this year, contributing to a narrowing of the current account deficit compared to 2019 (excluding the one-off fine paid by Gazprom). A net positive impact on GDP growth may appear if such countries also manage to redirect those normally spending their holidays abroad to domestic destinations this year. In the majority of CIS countries, domestic tourism already matters more than foreign.

Elsewhere in CEE, Turkey and Romania have a significant share of domestic tourism, making local travel restrictions and attitudes among residents almost as important as those for foreigners. Many countries have already started to adopt measures that would support their domestic tourism industry. In Russia, the government has also recommended its citizens to spend their summer holidays within the country, with local travel restrictions likely to be lifted much earlier compared to those for foreign travel. In almost all other CEE countries, which are much more reliant on foreign tourism, such policies are likely to be a lot less effective. The reason is that they just do not have enough wealthy residents to substitute for the drop in high-spenders from developed European countries, who are likely to prefer local tourism this year.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox