Eastward Ho! The euro area’s push into the Balkans

The inclusion of the Bulgarian lev and the Croatian kuna in the Exchange Rate Mechanism II (ERM II), which was announced last Friday, marks a crucial step for both countries to becoming the 20th and 21st members of the euro area. Bulgaria and Croatia won’t imminently join the currency union, though. As stipulated in the Maastricht Treaty, prospective members are expected first to demonstrate at least two years of exchange rate stability—in particular no devaluation of their currencies against the euro—in the ERM II. Further convergence criteria have to be met with regards to inflation, long-term interest rates and sustainability of public finances.

Undoubtedly, a membership in the euro area would have profound consequences for Bulgaria and Croatia. But, conversely, there would also be implications for the currency union as a whole when expanding into the Balkans. I survey three of them below.

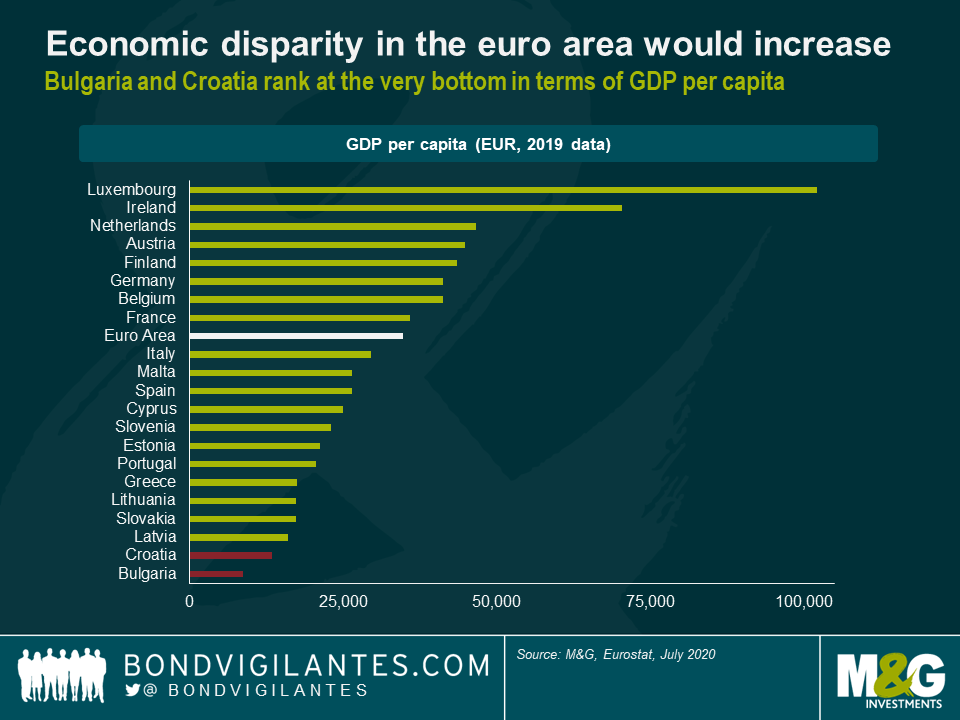

(1) Rising economic disparity

First of all, economic disparity within the euro area would rise significantly. Using 2019 Eurostat data, Croatia and especially Bulgaria have substantially lower GDP per capita numbers than any of the 19 eurozone members. The GDP per capita of Latvia—currently the worst performing euro area country by this measure—is still nearly twice as high as Bulgaria’s figure. Moreover, Bulgaria’s GDP per capita is only around one quarter of the euro area average and less than 10% of Luxembourg’s number. That’s a substantial discrepancy. In comparison, GDP per capita differences among the 50 U.S. states are much more benign. The figures of Massachusetts at top of the list and Mississippi at the bottom are only off by a factor of two.

Rising disparity would by no means be limited to GDP per capita. Also with regards to annual net earnings, disposable income, labour cost levels, etc., the lower bound of the euro area range would be shifted downwards when including Bulgaria. It should be noted, however, that there are other key economic parameters, such as unemployment rate or GDP growth, in which Bulgaria and Croatia have performed better than the eurozone average. Still, I think it is fair to say that the expansion into the Balkans would be accompanied by growing heterogeneity and inequality within the eurozone, which begs the question of what this may mean for cohesion and stability of the currency union.

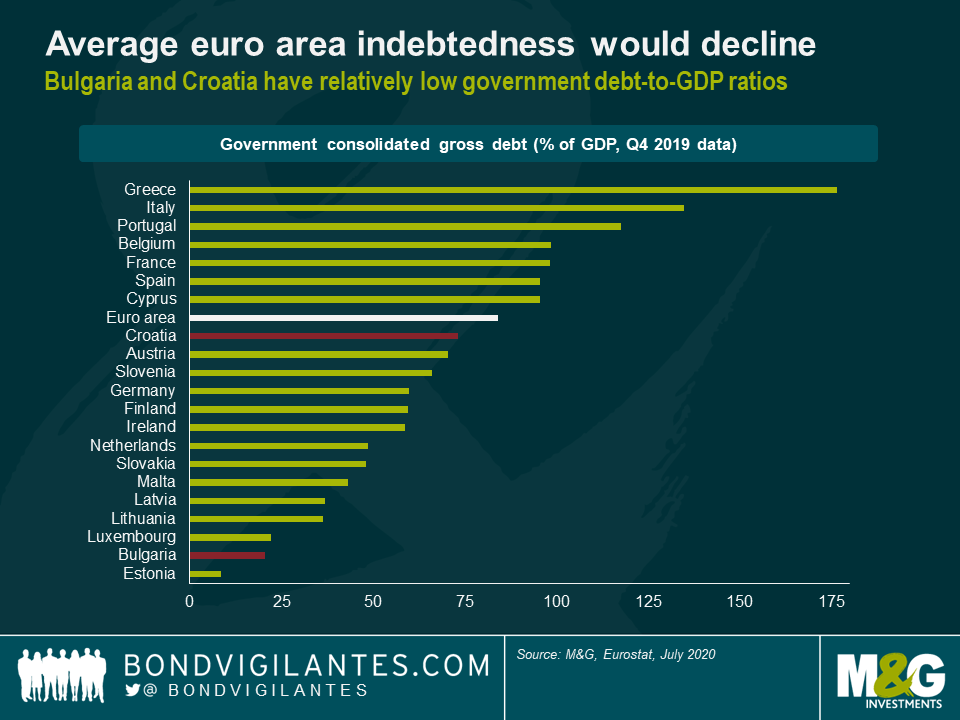

(2) Lower average government indebtedness

Second, average government indebtedness in the euro area would decline, if only marginally. Based on Q4 2019 Eurostat data, the government debt-to-GDP ratios of both Croatia (73.2%) and, even more so, Bulgaria (20.4%) are below the euro area average. In fact, Estonia (8.4%) is the only eurozone member with an even lower ratio than Bulgaria.

And, at least before the COVID-19 crisis struck, there was little reason to assume that government indebtedness was on the rise in Bulgaria and Croatia. In 2019, both countries had a budget surplus—+2.1% for Bulgaria and +0.4% for Croatia—whereas the euro area as a whole featured a budget deficit of -0.6%.

It should be noted that Croatia’s debt-to-GDP ratio exceeds the 60% maximum level, enshrined in the Maastricht Treaty, by more than 10 percentage points. But the rule hasn’t been enforced zealously in the past, to say the least, as both Italy and Greece joined the euro area with government debt-to-GDP ratios beyond 100%. Moreover, it is anybody’s guess whether or not the 60% limit will carry significance at all in a post-COVID-19 world in which public debt levels will have risen drastically across the board.

(3) Dilution of voting power of smaller economies in the Governing Council

Third, the expansion of the euro area into the Balkans would shift the power balance in the Governing Council of the European Central Bank (ECB) more towards the larger economies. The Governing Council is the ECB’s main decision-making body and is responsible for setting the monetary policy in the euro area. It comprises six Executive Board members and the governors of the national central banks (NCBs) of the eurozone’s member countries.

Up until 2014, all council members had both a voice and a vote at every Governing Council meeting. However, over the years the number of eurozone countries, and thus Governing Council members, grew, making consensus-building and decision-making increasingly challenging. Therefore, when Lithuania joined the euro area on 1st January 2015, a rotation system, not dissimilar to the one used by the Federal Open Market Committee of the Federal Reserve, was introduced.

In the new system, the total number of voting members in every Governing Council meeting is set at 21. The six Executive Board members have a permanent voting right at every meeting. The remaining 15 votes are allocated between the 19 NCB governors, who are split into two groups. The NCB governors of the five largest eurozone economies—Germany, France, Italy, Spain and the Netherlands—form the first group and share four votes. Voting rights rotate monthly, which means that every month one of these NCB governors will not be eligible to vote. The second group comprises the NCB governors of the 14 smaller eurozone economies, who share the remaining 11 votes. Hence, on a rotating basis, three of these NCB governors have to forgo voting at each Governing Council meeting. It should be highlighted, however, that Governing Council members without a current voting right are still allowed to attend meetings, present their arguments, participate in the discussions, and thus influence the decisions of the voting Governing Council members.

As it stands, the current voting system—21 votes in total, with tiering of NCB governors into two groups—will persist as and when Bulgaria and Croatia join the euro area. As both countries would be classified as smaller eurozone economies, the 11 votes reserved for this group of NCB governors would then have to spilt by 16, and five of these NCB governors wouldn’t be able to vote. The voting power of smaller economies in the Governing Council of the ECB would thus be diluted and the balance of power would shift more towards the larger economies.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox