ESG-themed corporate bond issuance – too big to ignore

Summary: ESG-themed bonds are gaining increasing market share – so much so that they can no longer be ignored by fixed income investors, whether you run sustainable portfolios or not. We wrote earlier this year on the various forms of those ESG-themed bonds that have come to market. For starters, ESG-themed bonds are those in which the credit-risk of the issuance is pari-passu with same-seniority ordinary bonds of the issuer. What makes them special, however, is that such bonds actively drive positive environmental and social outcomes via clearly-defined rules around the use of proceeds or, in the case of sustainability-linked bonds, that the corporate entity targets defined sustainability improvement during the lifetime of a bond.

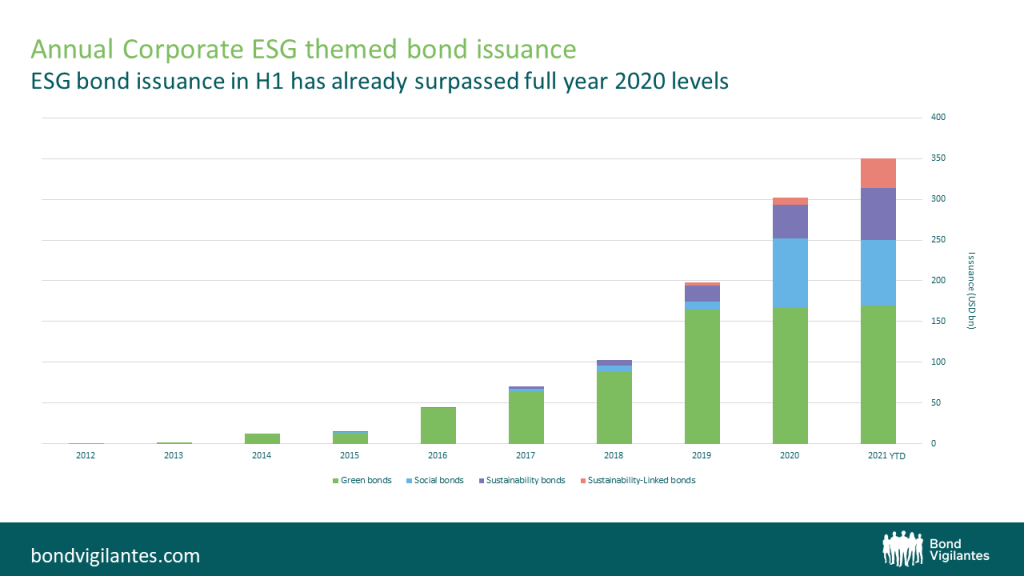

With the first half of 2021 having just come to a close, the timing couldn’t be better to take stock and analyse the supply dynamics of these ESG-themed bonds. In the first six months of 2021, investors saw corporates issuing new ESG bonds worth $350 billon. Helped by generally strong issuance this year, this year’s ESG bond issuance already surpasses the supply of ESG bonds over all of 2020.

Source: M&G, Bloomberg, June 2021 – issues below $100m excluded.

Green bonds continue to be the most utilised for corporates, with issuance standing at $169 billion year to date. The real estate, utility and banking sectors were responsible for 33% of the green bonds issued this year. In second place, social bond issuance is trending at $81 billion and is dominated by supranationals and banks, both well-placed sectors to support social projects such as social housing developments. A further $64 billion has been issued in the form of sustainability bonds (which finance projects with a combination of environmental and social goals), a concept that is gaining increasing popularity in the US.

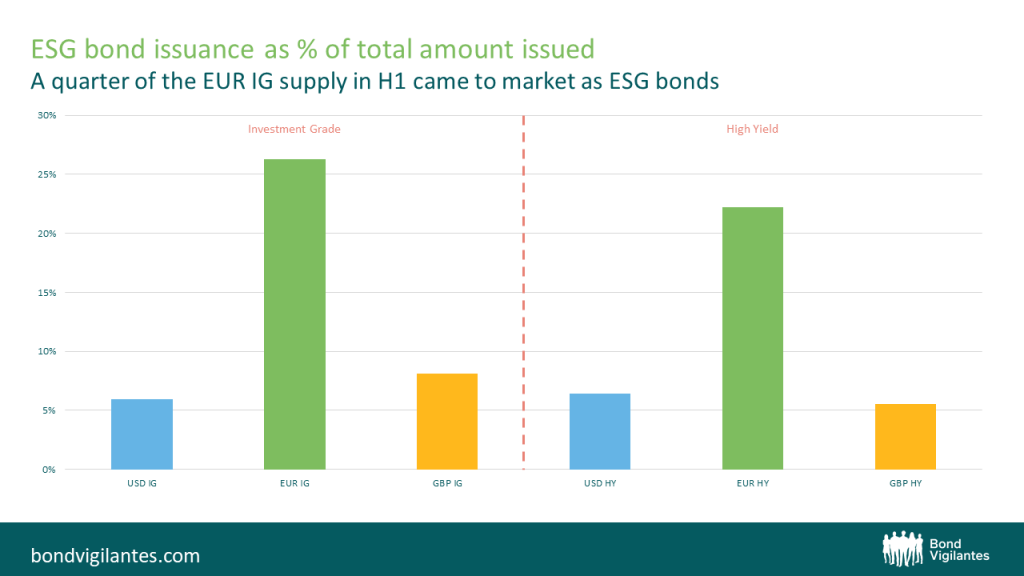

To put these numbers into context, ESG bond issuance in 2021 comprises 26% of total EUR investment grade corporate supply. In other words, every fourth Euro raised in EUR investment grade was issued with certain environmental or social targets. High yield ESG bond-themed issuance in 2021 is also worth 20% of total EUR high yield supply, revealing the wider use of the green bond concept by EUR high yield issuers.

Source: M&G, Bloomberg, June 2021 – issues below $100m excluded.

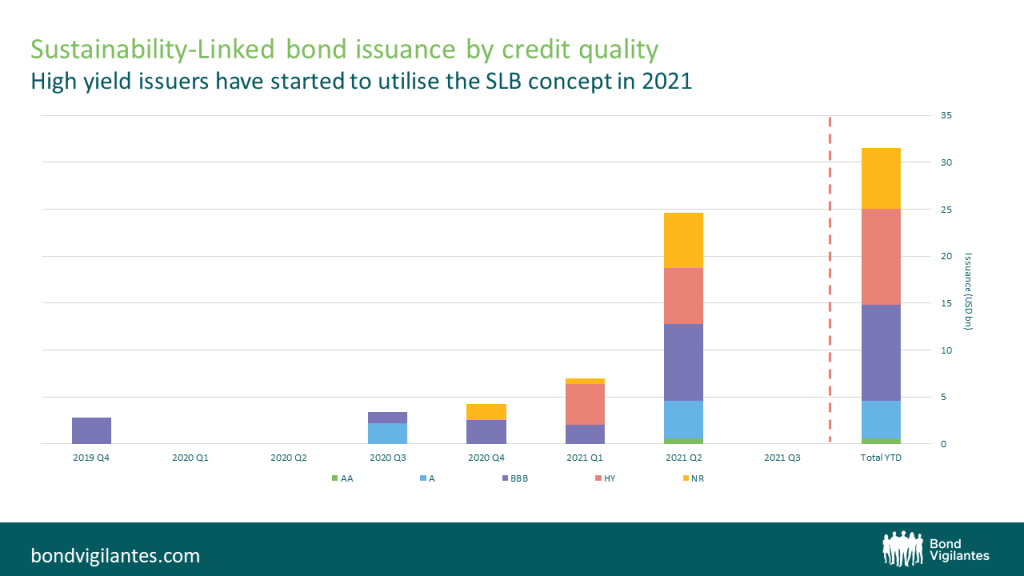

What has caught many investors’ attention the most in 2021 is the rapid rise of sustainability-linked bonds (SLBs). These bonds, which link coupon payments to clearly-defined targets at a corporate level, accounted for 10% of total ESG corporate bond issuance volumes year to date, compared to only 3% in 2020. So far, most of those sustainability KPIs are linked to environmental metrics which are arguably easier to measure than social ones. High yield issuers have started to embrace the SLB structure in 2021 too. As shown in the chart below, one third of the sustainability-linked bond supply in 2021 came from issuers with a high yield credit rating; prior to this, high yield SLBs have been non-existent. An increase in take-up doesn’t come as a surprise given that the embedded flexibility around the Use of Proceeds linked to SLBs is more suitable for high yield companies, given their generally smaller capital structures and that they raise debt less frequently than investment grade issuers.

Source: M&G, Bloomberg, June 2021 – issues below $100m excluded.

With more supply comes even greater need for quality assessment. We need to remember that ESG-themed bonds are self-labelled. Bond investors need to perform additional due diligence to ensure that the ESG targets set are in the spirit of their investment philosophy. Last month for example, a US meat producer that recently pleaded guilty to US foreign bribery charges came to market with a sustainability-linked bond. It is debatable whether a company with severe governance issues should tap the market with sustainability-linked bonds, and investors need to be aware of such potential conflicts. The same goes for the deal structure of ESG-themed bonds. Earlier this year, a French high yield issuer brought a SLB to market with a coupon step up of only +12.5bps. It is hard to justify such low coupon increases unless combined with highly ambitious Sustainability Performance Targets which, in the view of many market participants, was not the case in this instance.

Having said that, the increase in supply brings welcome diversification to the ESG themed investment universe by sector, region and credit rating. It will also help to improve secondary liquidity of those instruments and address some supply-demand imbalances that currently exist and can lead to an ESG bond valuation premium. If the current trend continues, the scene is set for another impressive round of ESG-themed bond issuance in the second half of 2021. Bond investors, stay tuned.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox