Let’s sit down and discuss your performance Mervyn…

Six years ago this month, Gordon Brown, who was Chancellor of the Exchequer at the time, set the Monetary Policy Committee (MPC) an inflation target of 2.0% for the Consumer Prices Index (CPI). Additionally, if the inflation target is missed by more than 1 percentage point on either side – in other words, if the annual rate of CPI is more than 3.0% or less than 1.0% – the Governor of the Bank, as Chairman of the MPC, has to write an open letter to the Chancellor explaining the reasons why inflation has increased or fallen to such an extent and what the Bank proposes to do to ensure inflation comes back to the target.

With such a clear and transparent policy objective, I thought it might be useful to have a look at how the Bank of England has performed in achieving this target and how well it may do in the future.

The announcement in 2003 that the MPC was to target the CPI was not a radical development, as monetary policy had been targeting various levels and measures of inflation since 1992. This was simply the adoption of a new inflation measure, a new target rate of inflation and is the objective that the MPC still has today. And that’s the yardstick that I am going to use to rate his performance.

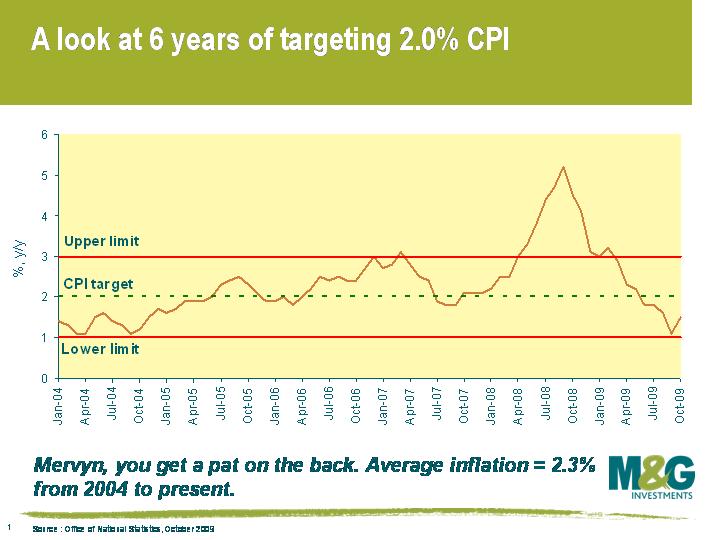

Since 2003, the average annual rate of CPI has been 2.3%. Governor King has had to dip his pen into his inkwell on 5 different occasions to explain to the Chancellor why the inflation target was missed. CPI inflation on all of these occasions was more than 1 percentage point above the 2% target. Of the 70 monthly observations of the CPI since January 2004, CPI has been or exceeded 3.0% on 12 occasions and never fallen below 1.0%. If you consider that we’ve had an environment of rising commodity prices, a housing boom and relatively low unemployment (and more recently a sharp reversal of all these things), only missing the inflation target by 0.3 percentage points suggests that the MPC and Mervyn King have done a reasonable job.

Since 2003, the average annual rate of CPI has been 2.3%. Governor King has had to dip his pen into his inkwell on 5 different occasions to explain to the Chancellor why the inflation target was missed. CPI inflation on all of these occasions was more than 1 percentage point above the 2% target. Of the 70 monthly observations of the CPI since January 2004, CPI has been or exceeded 3.0% on 12 occasions and never fallen below 1.0%. If you consider that we’ve had an environment of rising commodity prices, a housing boom and relatively low unemployment (and more recently a sharp reversal of all these things), only missing the inflation target by 0.3 percentage points suggests that the MPC and Mervyn King have done a reasonable job.

The Bank of England targets inflation because inflation distorts resource allocation, reduces economic growth, hurts the poor, creates social and political instability and is painful to reduce once it becomes entrenched in an economy. And the Bank of England’s inflation target is important for bond vigilantes because inflation targeting by an independent central bank creates inflation credibility. Central banks seek to meet their inflation targets by setting an interest rate (the Bank Rate) that is appropriate for meeting these targets. You can argue that inflation targeting has its shortcomings, and when the bank rate falls towards zero then central banks have to look to other measures to reach the inflation target over the medium term (such as Quantitative Easing).

Looking forward, things are likely to get much more difficult in 2010 and beyond. It appears that Mervyn would do well to have his pen at the ready because he could be writing a few more letters to the Chancellor. By the BoE’s own admission, inflation is likely to rise above 3.0% in the coming months, reflecting year-on-year effects (so called ‘base effects’), driven by higher petrol price inflation and the reversal of last year’s reduction in VAT.

Does this mean no more QE then? There are reasonable grounds to extend QE further, since the UK economy is still (officially) in recession, money supply growth is feeble, and unemployment has showed no signs to date of improving. But will the Governor be writing to the Chancellor to explain why inflation has risen over 3.0% at the same time he is asking for another increase in quantitative easing beyond the £200 billion that the Bank has already done?

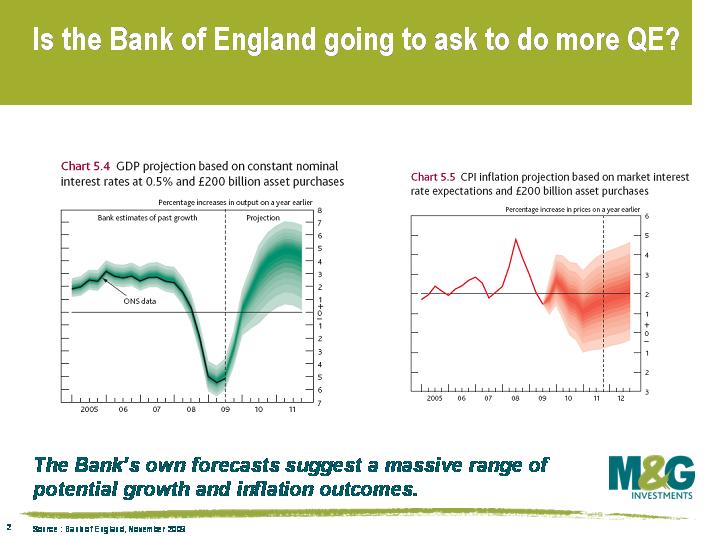

Politically, it appears only possible to extend QE while inflation is breaching the 3% upper limit if the BoE has great confidence that inflation will later fall back to target. The Bank of England currently believes this spike should prove temporary, but as can be seen from the fan charts depicting the BoE’s inflation and growth projections in last month’s Quarterly Inflation Report, it doesn’t have great confidence in either its growth or its inflation projections, so I think we’ll most likely have a pause in QE in February.

Politically, it appears only possible to extend QE while inflation is breaching the 3% upper limit if the BoE has great confidence that inflation will later fall back to target. The Bank of England currently believes this spike should prove temporary, but as can be seen from the fan charts depicting the BoE’s inflation and growth projections in last month’s Quarterly Inflation Report, it doesn’t have great confidence in either its growth or its inflation projections, so I think we’ll most likely have a pause in QE in February.

Something else that will very likely be on Mervyns’ mind is that he is becoming less and less in control of his own performance. Central bankers only control monetary policy, and now the bank rate is at 0.5%,monetary policy is losing its effectiveness. Even more of a problem is that central bankers don’t have control of fiscal policy. Large budget deficits for a prolonged period of time will inevitably prove to be inflationary eventually, and everybody wants to avoid a situation whereby monetary policy is being tightened in an effort to counter loose fiscal policy, because that’s a sure way of creating a sovereign debt crisis.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox