BofE: The unreliable boyfriend finally comes through with the chocolates

The Bank of England unanimously raised its benchmark interest rate by 25 basis points to 0.75% – are gilts still an attractive investment opportunity? Are rising rates the main challenge to UK government and corporate bonds? Has Brexit risk been priced in?

Is the Bank of England right to raise rates?

The unreliable boyfriend finally came through with the chocolates – after months of going back and forth, the Bank of England finally delivered what everybody had been expecting for months. The tightness of the labour market may have been the main reason behind all MPC members agreeing on the hike today – perhaps this tightening of the labour market is a bit beyond their comfort levels.

This hike shouldn’t raise any eyebrows: Unemployment is at its lowest since 1975, unit labour costs are on the rise, PMIs are looking healthy and inflation is above target. Increasing the rate 25bps seems entirely reasonable.

In a rising rate environment, are gilts still an attractive investment opportunity?

Rising yields make bond prices fall – but sometimes the cushion provided by the coupon that investors get is large enough to absorb the price loss, which means that investors still get a positive return. In the UK, this is a bit trickier because UK bonds typically have longer maturities relative to other developed markets: this means that investors are exposed to more interest rate risk (or duration). In this sense, short-duration debt may be more attractive in a rising rate environment. As shown in the chart, short-dated Investment Grade (IG) UK corporate bonds offer one of the biggest cushions to protect investors against rates moving higher: their yield needs to rise by almost another 1% before investors lose money.

Are there any other instruments that could help investors in a rising rate environment?

Floating Rate Notes (FRNs) are another option. Like any other bond, their price will be negatively affected if rates rise, but their coupon will adapt to interest rate moves, so it will increase if rates do, helping hedge some of the risk.

Higher rates are not the only threat to UK bonds – how about Brexit? Is the risk priced in?

As seen on the chart, UK IG spreads have moved more in synchrony with US dollar or Euro-denominated corporate debt, which reflects global investors’ risk appetite and global macro concerns more than any Brexit issues.

This happens because:

- The UK IG index is not necessarily a reflection of the UK economy as the index is as internationalised as the FTSE 100, which derives c. 70% of revenues from abroad. For example, the largest issuer of the UK IG index is EDF, a French company, which accounts for c. 2.5% of the index. Of the top 10 issuers, only Heathrow has all of its infrastructure within the UK.

- UK companies have issued debt in other currencies, such as US dollars and euros. This would include leading issuers, such as banks, including HSBC, a major issuer. As for Britain’s small and middle-sized companies, they tend to use more bank debt or other private sources rather than financial markets. The High Yield market, which is widely used by smaller companies in the US, is also relatively small in the UK.

- Political uncertainty: At the moment it is hard to predict the final outcome of Brexit. UK politicians seem to disagree on many aspects of the deal, which in any case will also have to be negotiated with the EU. We are still a far way off any certainty.

- Credit is a bottom-up creature: In the corporate world spreads reflect company fundamentals. In the US we saw how higher tariffs led Harley Davidson to announce moving some of its manufacturing facilities outside the US – they are doing the best for investors. Sterling issuers, such as big banks (which account for about one quarter of the index), are already considering doing the same, so in this sense, spreads would not necessarily widen as profits wouldn’t be affected.

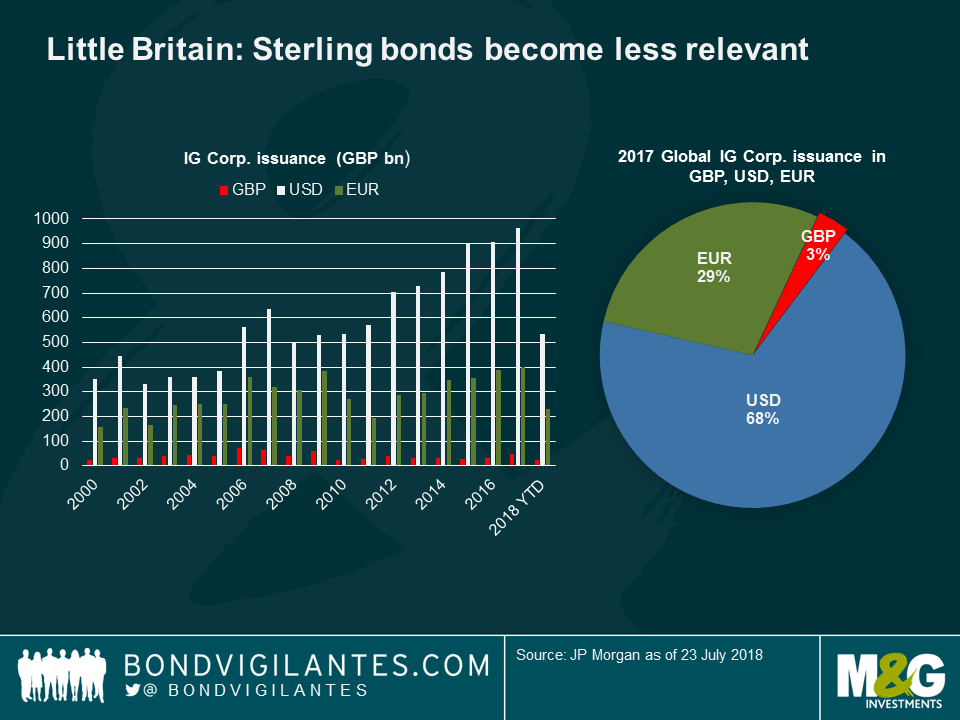

- The UK debt markets may not be as important as they have been in the past: The creation of the Eurozone and the globalisation of finance that we have seen over the past two decades means that Britain’s role in financial markets has diminished (see chart below). Also, given the tensions in the ongoing trade talks, international companies may be apprehensive about issuing in the UK.

The effect of Brexit on UK companies’ funding may come more through the banking system, as a weaker currency may lift inflation, pushing the central bank to increase interest rates. This would translate into higher borrowing costs for British companies.

Should UK investors look abroad?

Absolutely – diversification pays off, especially in delicate times. There is a big wide world in Fixed Income markets, much deeper and broader than what leading benchmark indices reflect.

Interested in a weekly summary of global bond markets? Don’t miss the Bond Vigilantes’ new’ “Panoramic Weekly,” published every Thursday. Read today’s: EMs 1 – Trump 0

Don´t miss Matthew´s video: Bank of England – is it right to raise rates?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox