Emerging Market debt: 2014 returns post-mortem and 2015 outlook

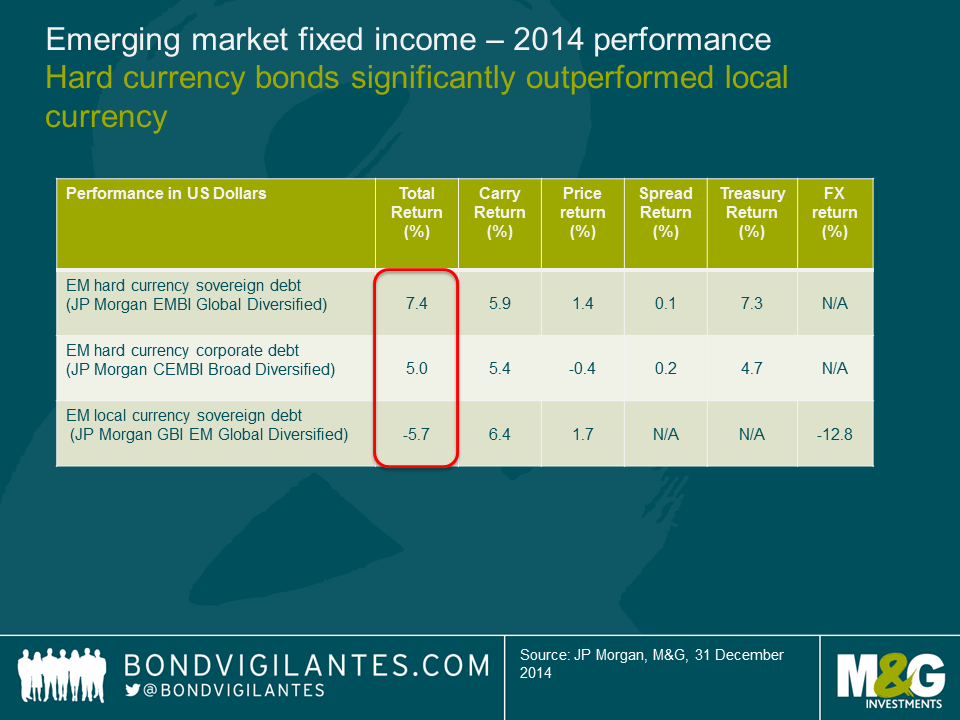

2014 was quite an eventful year for Emerging market (EM) fixed income. After a period of strong performance which lasted all the way to September, markets corrected significantly in the latter part of the year as the escalation of the Russia crisis and the plunging oil prices triggered the most significant drawdown since the “taper tantrum” of June 2013. All in all, emerging markets still posted a positive total return in 2014, despite the declines in local currency markets (see chart 1). Particularly important at this point of the cycle, asset allocation and avoiding a few deteriorating credits were key for performance.

- Duration was one of the largest surprises in 2014

US Treasury yields rallied and this was one of the main tailwinds for returns – and also one of the biggest surprises of 2014. This made the asset allocation between hard currency and local currency a critical call – much more than what I had anticipated. While lower oil and commodity prices can help at the margin, they matter much less for US CPI than for other EM countries. The labour market and wages should remain more relevant for US monetary policy.

- Spreads widened, particularly in oil related credits

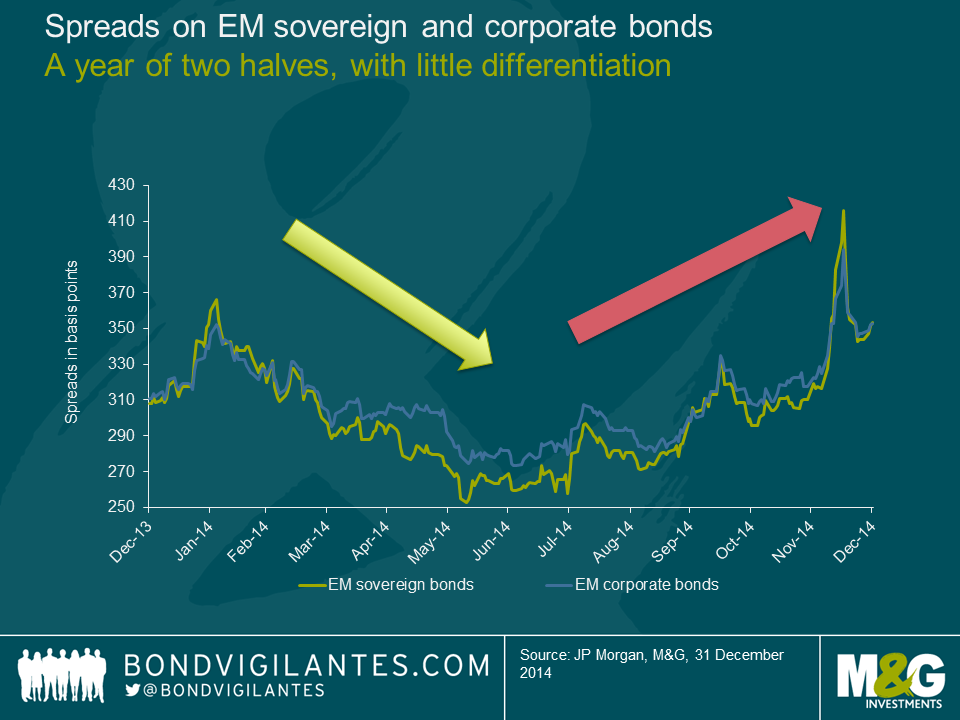

Sovereign and corporate bond spreads ended the year about 40 basis points wider.

However, this masks two very distinct periods: tightening until the summer (as investors had been cautiously positioned in terms of risk and had to invest given the inflows into retail bond funds) and widening since then (as inflows have been reduced and risks have risen, particularly for the oil exporting countries). The latter countries have been the clear underperformers as the price of crude oil tumbled from $75 to $55 USD per barrel. With the markets testing OPEC’s response (or lack thereof), the oil credits will remain under pressure until there is more clarity on what the new floor for oil prices is.

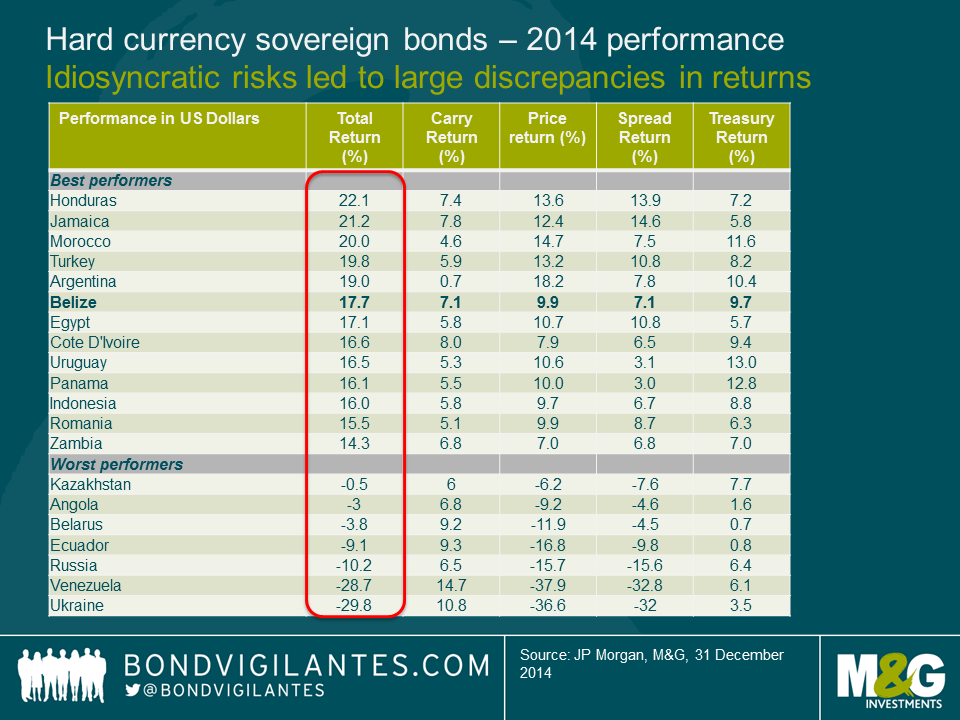

Despite the recent correction, the asset class has been able to cope thus far with lower capital inflows than in prior years and this is part of a multi-year adjustment. The dispersion of returns between hard currency sovereigns and corporate bonds was lower than I had anticipated – partially reflecting the more benign US rate environment, with the tails impacting primarily weak credits such as Venezuela and Ukraine.

For 2015, I expect higher dispersion of returns, particularly in the credits that are under scrutiny by the markets. The jury is still out on whether these governments will deliver the required fiscal or structural adjustments necessary to stabilize debt levels (including countries that are being squeezed by lower commodity prices) and structural reforms required to increase potential growth. I remain very cautious on security selection in Brazil and South Africa and am avoiding select frontier markets (Ghana, Costa Rica, Serbia) and oil credits (Bahrain, Ecuador), where I believe investors are underestimating risks and where the adjustments are likely to disappoint.

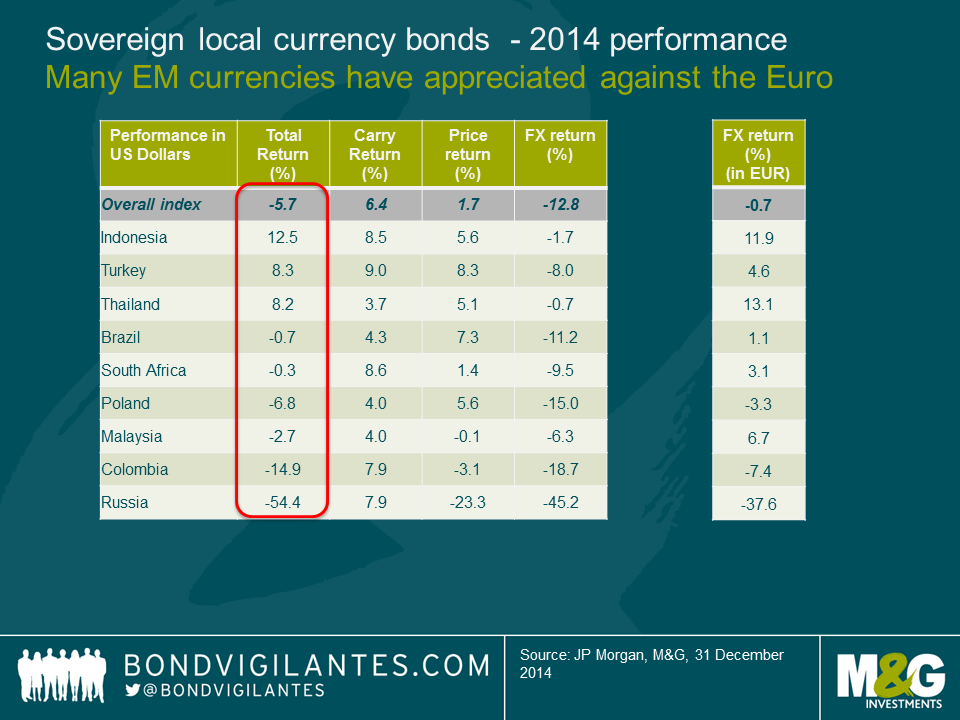

- Local currency debt: currency again leads to underperformance

The US yield rally helped to anchor local currency curves in various countries, but was not enough to offset the negative returns from EM currency depreciations against the US dollar. In all but one market (China), rates outperformed currency returns. EM currencies actually outperformed several developed currencies, particularly the EUR, but also NOK (oil theme) and AUD/CAD (commodity theme) and I view this year as being largely a USD rally as opposed to an EM sell-off (the Ruble being the most notable exception). In many instances, the currency depreciation has been relatively orderly and/or has not had a negative effect on sovereign or corporate balance sheets. Hence, it has not contributed to significant spread widening. A few countries, however, remain under severe pressure and have been amongst the underperformers. The magnitude of the Russian underperformance was staggering, which was one of the factors that caused its GBI-EM index weight to be reduced from 10% to 5%. EM local currency debt would have delivered only a small negative return (about -1%) had Russia been excluded. I remain cautious on currencies where the adjustment is still incomplete and where terms of trade have worsened, particularly in less flexible regimes such as Nigeria or former Soviet Union countries with strong economic linkages to Russia. After having a relatively low allocation to local currency debt in 2014, I am looking to selectively add exposure in 2015 to countries where the current account adjustment is advancing and/or valuations undershoot fundamentals. Indonesia and India were such examples in 2014 and managed to perform well despite a strong USD environment.

- Idiosyncratic risks abounded, keep seatbelts on

I expected idiosyncratic risks in 2014 to become a more relevant source of returns, particularly political risks. I factor political risk by assessing whether it impacts the economy and whether the economy impacts asset prices, which is what we ultimately invest in.

In some cases, political risks had a positive impact (e.g. Indonesia and India). In other cases, while it impacted the economy, it had muted impact on asset prices (e.g. Thailand, which has had a long history of military involvement, with typically little impact on asset prices).

In other cases, political risks increased materially (e.g. Russia and Ukraine), which is having a significant impact on their economies and asset prices. I remain cautious on our exposure to these countries, as the ongoing instability risks spilling into a banking and regional crisis. One year into the conflict, I still do not see a speedy resolution in sight as the positions remain far apart and the west in no hurry to lift the economic sanctions, particularly the US. I wrote a blog on this last April which is available here.

Near the extremes, good returns in Argentina (despite being partially in default) and weak ones in Venezuela (not yet in default) highlighted the expectations for better economic policy in the former (post October 2015 elections) and little hopes of adjustment in the latter, made even more critical given lower oil prices.

For 2015, the election calendar will be much quieter than in 2014. The focus will turn into implementation of reforms, ongoing geopolitical issues and the policy response (or lack thereof) of countries that are being hurt by weakening terms of trade. This is particularly true for a few important countries, such as Brazil. While I view the recent cabinet appointments as a step in the right direction in terms of a better policy mix, we need to see steadfast and prompt improvements on the fiscal adjustment to anchor expectations and prevent a ratings downgrade.

In sum, I expect asset allocation between hard and local currency to remain a key driver particularly in the earlier part of 2015. Credit selection within the hard currency space will remain even more important than it was in 2014 as I expect return dispersion to increase and avoiding the tail-risk underperformers remains key.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox