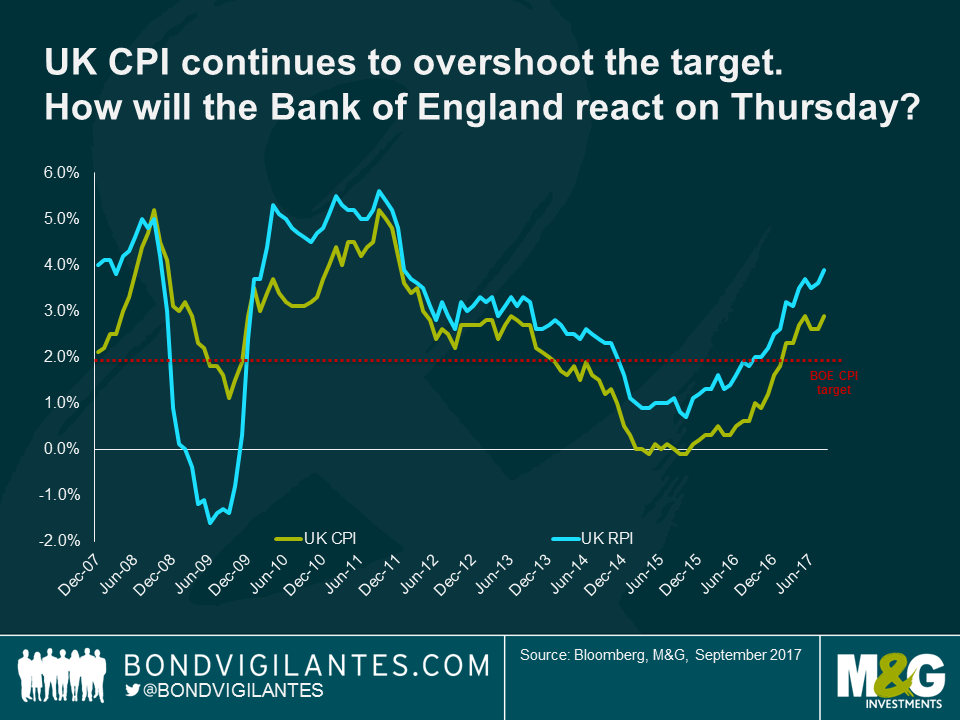

CPI now 2.9% up from 2.6% last month, above expectations and overshooting the Bank of England forecast

UK CPI is now within a hair’s breadth of requiring a letter to the Chancellor. RPI increased to 3.9% from 3.6%, which was also above expectations. The increased fuel prices were expected this month, but August is also a high inflation month given transport price hikes that take place as people head away for their holidays, and as clothing and footwear prices are hiked with the new season’s collections coming to shop shelves.

But it seems likely that we are close, now, to peak inflation in the UK. Given this, I feel that the MPC should look through any headlines this week and stay their course, given concerns around the outlook for the consumer, and enormous uncertainty about the post March 2019 economy. That being said, I believe that the risks of a 6-3 vote have risen materially on the back of this number, as Andy Haldane has been pretty explicit on his discomfort with present levels of inflation, even if they are due to currency weakness and imports.

Increased disagreement on the MPC will likely lead to some sterling strength, in the short term at least, and it could see some downward reaction in short dated breakevens. But if we are a month or so away from peak inflation, to hike rates, strengthen the pound and reduce breakevens would be overly myopic and pro-cyclical in my view. It seems likely to me that inflation and breakevens are going to start to slide back from here gradually anyway: why accelerate and exaggerate those moves by acting a month or two early?

Perhaps heightened disagreement and debate though is the right policy, especially when combined with at least a cursory discussion on the potential need to raise rates more aggressively than the market is pricing in? If you think inflation does fall back from here, then perhaps you remain bullish on rates and don’t expect the first hike to come in the middle of 2018 and the second hike to come at some point in the second half of 2019. If inflation doesn’t fall back for whatever reason (likely to be sterling weakness on account of Brexit debates), then you probably need to start bringing forward rate hikes and increasing their number. With 10 year gilt yields at 1%, though, the bond market remains firmly nervous on the economy and unconcerned about the risk of hikes at this highly uncertain moment in time.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox