UK inflation soars, but beware of the hysteria

Expectations had been for a big jump going into this morning’s release of December UK inflation statistics, however expectations still weren’t high enough. The year-on-year CPI inflation rate surged from +1.9% to +2.9%, eclipsing the average forecast of 2.6% (economic forecasts varied from as low as +1.9% to +2.8%). This marked the biggest jump in UK CPI since April 1991.

Why the big jump? Well we already knew that inflation would rise sharply, which was simply due to base effects (as we mentioned here). The inflation rate in December 2008 has just dropped out of the year on year number, and this deflationary month was important since it was when VAT was cut from 17.5 to 15%, and was also a month of heavy discounting by retailers. In addition, the high year on year numbers are reflecting the fact that energy prices were at their most depressed at the beginning of 2009 (oil prices alone added almost 0.3% to today’s CPI number), although this inflationary impact will gradually unwind over the coming months.

The bad news is that the VAT increase isn’t yet in the data. This month’s increase in VAT from 15% back to 17.5% doesn’t appear in the data until the inflation rate for this month is released in one month’s time, so it now looks very likely that Mervyn will soon have to start writing letters to Alastair Darling explaining why UK CPI has exceeded the upper limit of 3%.

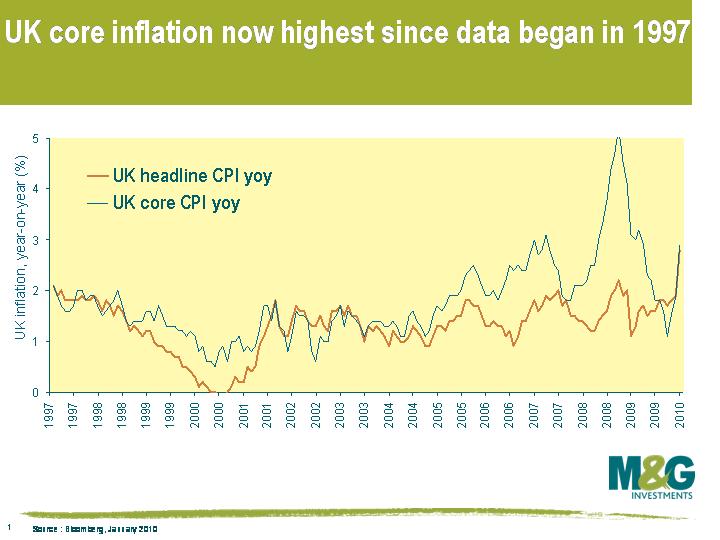

Further bad news came in the form of core CPI, which rose from 1.9% to 2.8%,the highest rate since data began in 1997. Core inflation is a less volatile measure since it excludes energy, food, alcohol and tobacco, although it is clearly still affected by base effects, the weakness of sterling and changes in VAT (see a critique that Richard wrote of core vs headline back in 2007 here).

Does this therefore mean that the inflation genie is out of the bottle? Very unlikely. Spare capacity in the UK economy is still huge, bank lending is weak, and money supply growth remains feeble, in spite of the Bank of England’s best efforts at creating money (note that this doesn’t mean that QE hasn’t worked – we have no idea what the growth or inflation rate would be right now if we’d never had QE). It’s difficult to see how inflation can be generated, unless energy and food prices skyrocket over the remainder of this year or sterling collapses (sterling has actually strengthened today on the inflation news today rather than weakened). We expect inflation to fall back again from the middle of this year once the base effects fall out of year on year numbers. The MPC will also be looking through today’s data release, and I can’t see this upside inflation surprise kickstarting any rate hikes – remember that the bank rate is set with a 2-3 year view of where inflation is likely to be, not a 2-3 month view.

Finally, it’s worth highlighting something I mentioned a few months back regarding inflation-linked gilts (see here). Inflation-linked gilts are becoming a popular investment for people who are seeking to protect their portfolios against the risk of rising inflation, but some investors fail to realise that the return profile on these bonds isn’t just driven by what happens to the inflation rate, but also what happens to the ‘real yield’. The real yield is driven by things like pension fund demand and supply, and is also driven by what happens to conventional gilt yields.

The further out along the yield curve you go, the more duration you have. So the further out along the yield curve you go, the more the return profile on index-linked gilts is driven by what the real yield is doing, and the less the return profile is driven by where inflation goes over this year and next. Today, conventional gilts have predictably sold off on the inflation print – at the time of writing, 10 year gilt yields are 8 basis points higher (equivalent to about a 0.6% price fall), while 30 year gilt yields are 4 basis points higher (which is also equivalent to about a 0.6% price fall, owing to longer dated gilt prices being more sensitive to changes in yields, ie longer duration). As you’d expect, inflation-linked gilts have outperformed conventional gilts today as inflation expectations have risen slightly, but the UKTI 2.5% 2020 and UKTI 1.125% 2037 have still both fallen in price by around 0.3%.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox