Top Gun – what is Powell’s call sign?

“The fundamental change in our framework is that we’re not going to act pre-emptively based on forecasts for the most part and we’re going to wait to see actual data. I think it will take people time to adjust to that and to adjust to that new practice, and the only way we can really build the credibility of that is by doing it.”

Fed Chair Powell, 17 March 2021 via Bloomberg (19 March)

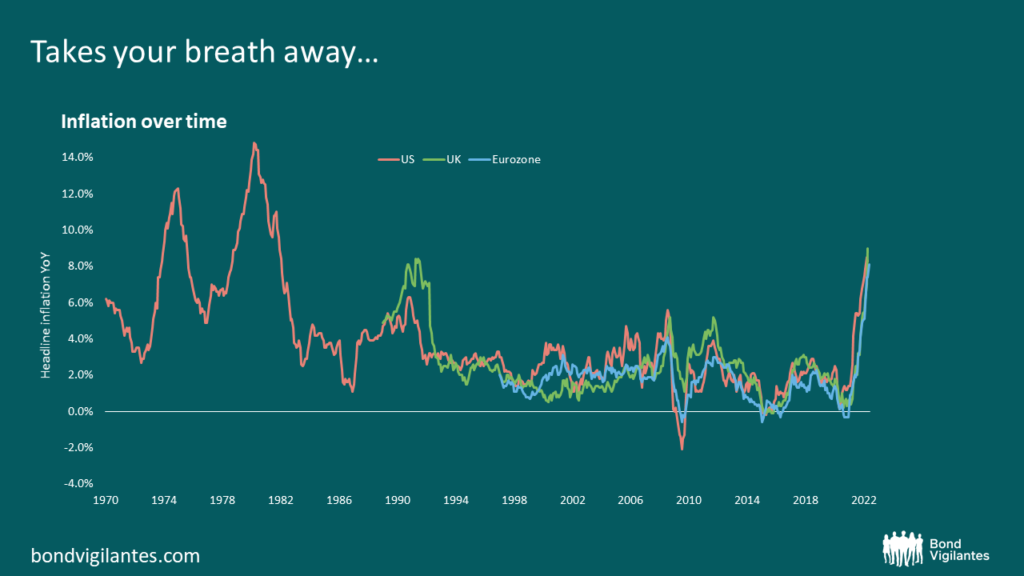

The market’s very own Top Gun made the Maverick statement above, emphasising the significant change in the monetary policy reaction function that took place just last year. This was a huge signal that they were prepared to run the economy hot, and boy did they break Mach 10! This theme was central to our Bravo Yankee Pappa blog. Central banks were going to escape the zero bound, we thought they would, but not by the stellar amount they actually have with inflation hitting generational highs.

This maverick manoeuvre in monetary policy is not what you expect to see from central banks – though given the low inflation altitude going into the Covid shock they needed to ditch the usual playbook. The markets are rightly very concerned now over the immediate outlook as they face a set of dangerous parameters that are new to them. What will the central bankers do next? Powell has two options:

- Powell could stick to his words above and stay reactionary, not proactive. Following this flight path implies super aggressive tightening to kill inflation, with recession of various degrees being accepted as collateral damage. This would imply high real yields at least in the short term and be bad news for credit, and likely lead to a high degree of market volatility as the Fed reacts in real time to real time data.

- Powell could recognise that he executed a one-off manoeuvre in monetary policy in exceptional circumstances and that we should find a flight path back to the conventional monetary policy of the past.

I think option 1 is not where Powell’s thoughts lie.

A maverick is someone who is prepared to think differently and unconventionally: I don’t think that is the right call sign for Powell or any central banker! In fact most central bankers would aspire to the Iceman call sign: intelligent, analytical, calm, though with the right amount of swagger to get under the market’s skin. How do they get from the current stated policy to the old playbook?

Central bankers could simply recognise the one-off battle predicament they found themselves in during 2020, and announce a return to their more pre-emptive Iceman approach. They can therefore temporarily ignore the ground-breaking inflation as a rule that had to be broken for a greater good. This would mean a period of above average inflation, and no need for a significant economic downturn.

The central banks will have difficulty in transitioning to the old approach: they will push rates higher, they will reverse QE, and maybe fly higher above the zero inflation bound on a permanent basis. Hopefully they do this in the style of Iceman, patient and forward looking as opposed to reactive, and therefore we can escape the current danger zone.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.