European Credit – From Bear to Bull?

As I have remarked to a number of clients in the last 2 months, this seems to be one of the most well-advertised bear market I have come across.

I remember towards the end of last year, whenever we sat down with credit strategists to discuss their 2022 crystal ball gazing exercise, they were almost uniformly bearish on European Credit markets for the year ahead. On one hand, it made me worried just how pervasive the bearish sentiment was, but on the other, I couldn’t really disagree with their broad conclusions – we ourselves had been bearish on European credit for much of last year.

Our investors know, we are completely value based investors – our bearish stance had nothing to do with the bleak macroeconomic picture the strategists were looking at. Rather, it was based solely on the increasingly expensive valuations we observed of European issuers. Fast forward 10 months, valuations have weakened once more, so it now seems timely to pose the question, are we now being compensated for taking risk once again in European credit?

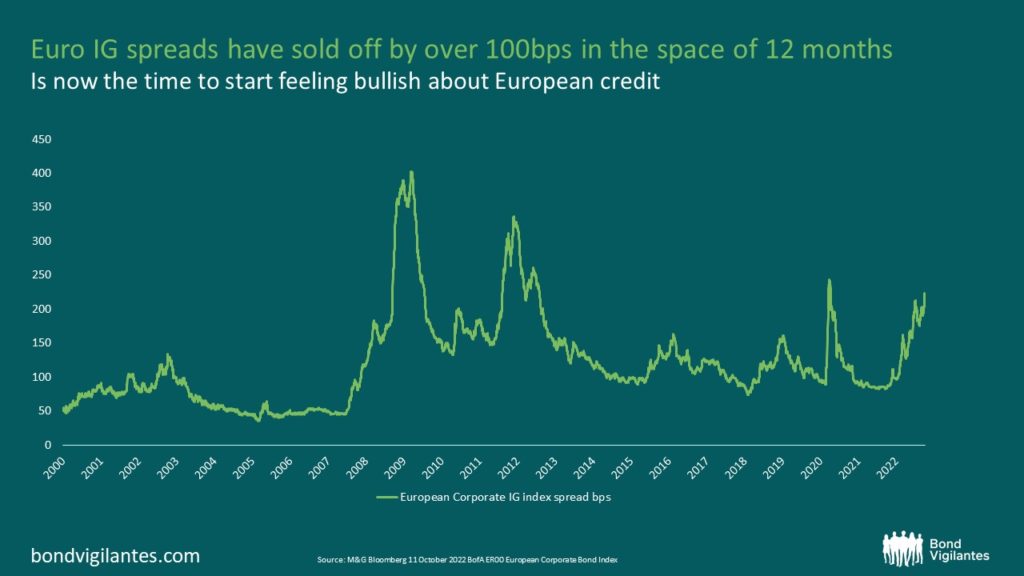

Euro IG spreads have sold off by over 100bps in the space of 12 months; is now the time to start feeling bullish about European credit once more? The interesting thing we note is that the majority of the credit strategists are still bearish. Even the very few who remained bullish at the end of last year, are bearish now. However, when I look at the valuations of European credit, I cannot help but feel increasingly constructive relative to how I felt 10 months ago. The reason for my conversion is, simply, valuations. The chart below, for example, plots the European IG spreads over the last 20 years.

Source: M&G Bloomberg 11 October 2022 BofA ER00 European Corporate Bond Index

Looking at this graph, it is fair to say that some amount of macroeconomic or even credit deterioration is beginning to get priced into the credit markets today. The question then becomes, is the current level of macroeconomic risk currently ‘priced in’ enough? That question inevitably leads us into the inexact science of forecasting the future, which has been the downfall of many investors. In reality, looking at the health of corporate balance sheets, consumer savings, and overall unemployment, you would like to believe that the coming recession might not be very severe. However, looking at how dependent our economies have all become to leverage and cheap/available credit, the sharp increase in interest rates feels we might be at the start of ‘the great unravelling’ of the leverage super-cycle, that started with the Federal Reserve QE back in 2007. The truth is, nobody can accurately predict whether a recession will occur, and if it does happen, how bad that recession is going to be.

However, what do we know? At present valuations, the credit markets are discounting close to a Covid-2020 scenario, when at that time the expectation was that significant chunks of the global economy would be temporarily closed. The proximity of markets today to that level of credit spreads to me, indicates this is a good entry point to start building a position in European Credit. It is entirely possible however that the eventual recession could be a very severe one, resulting in significant further deterioration of credit markets. Hence, it is quite important, to be in a position to add more, if the valuations move to price in such an outcome. However, unless one is absolutely certain how the macroeconomic situation is going to pan out, and the effect it will have on the credit markets, it might just be time to start buying European IG credit, while keeping the means to add more if valuations were to deteriorate further.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.