Rating agencies should act after non-calls

A quick glance at the Moody’s website reveals that “Moody’s long-term ratings … address the possibility that a financial obligation will not be honoured as promised”. While we would question the vagueness of that phrasing – what does “promised” mean here? – this is undoubtedly what credit ratings are supposed to do: give a fair picture of the likelihood of being paid back in full and on time. For most debt instruments, this is the same as likelihood of default, which can be measured through traditional credit analysis looking at cashflows, leverage and so on. However, in the world of EM banks, we have recently experienced the non-calls of various capital securities which had been priced to call when originally issued (for more detail on how capital securities are structured, see here). These non-calls did not constitute a legal default – that is not disputed. However, investors had expected calls to be exercised when buying the bonds. The most deeply subordinated bank bonds, Additional Tier 1 securities, would not legally default even if they were never redeemed and no coupon was ever paid, which is why they were priced to call. And more pertinently regarding credit fundamentals, not calling a bond can hit an issuer’s market access for subordinated debt, hindering the ability to build capital and damaging the issuer’s financial profile. In this new world of rising yields/spreads, where banks will face the choice between making non-economic calls or risking their market reputation, it has become more relevant to ask what constitutes “being honoured as promised”? Should rating agencies distinguish between banks who have a history of not calling and those that continue to do so, both to reflect reduced market access and because the decision not to call is often a management choice that cannot be detected by traditional financial analysis?

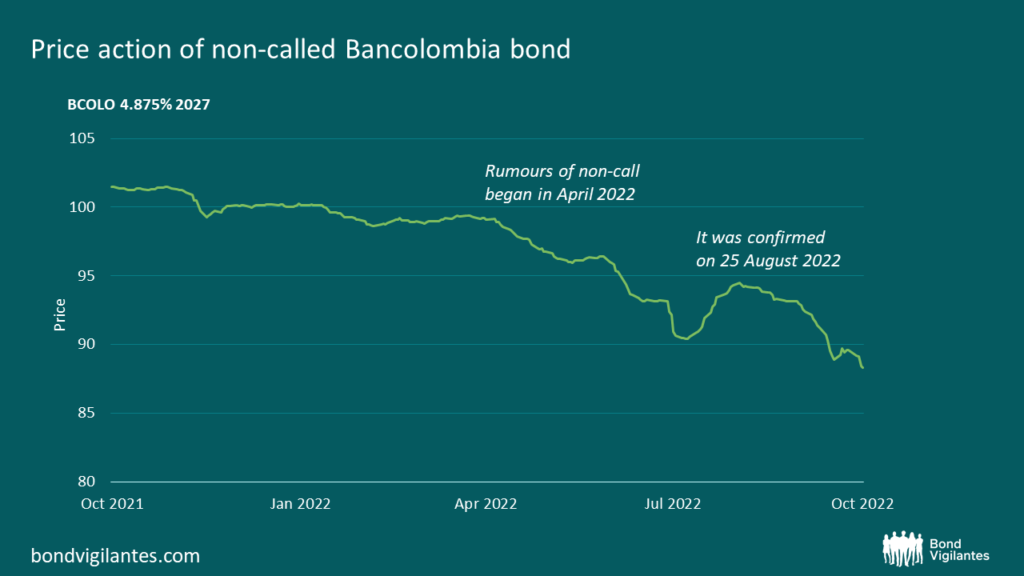

I recently wrote a piece arguing that banks should always call their subordinated debt instruments for reasons that included economic factors, financial stability and market access. A few months later, we find ourselves in a situation where Garanti (GARAN) in Turkey and Bancolombia (BCOLO) in Colombia have failed to call Tier 2 instruments, while it seems highly likely that Itau of Brazil will not call its AT1 bond in December for economic reasons (i.e. because it would be more expensive to issue a new instrument than to leave the current one outstanding). What is noteworthy here is that, while GARAN was apparently given no say in the matter by its owner BBVA, the other two incidents are voluntary choices made by banks that could have afforded to call, but chose (or could choose) not to do so. This is new territory for EM investors, for whom non-calls have previously been indications of financial stress for the issuer or its sovereign (e.g. Bank Dhofar in Oman in 2020). Rising rates and spreads strengthen the possibility of non-calls on economic grounds.

Source: M&G, Bloomberg (17 October 2022).

However, the good news is that we do not expect non-calls to become widespread as most banks realise that they still need access to international debt markets, not least for capital instruments which cannot be readily issued locally. Banco Votorantim and Banco do Brasil remain highly likely to honour their forthcoming AT1 calls. In Turkey, Vakifbank has just called its Tier 2 bond, despite it clearly not being “economic” to do so. This highlights the importance that banks (and, in many cases, regulators) tend to attach to maintaining their reputation in the market. They realise that they need market access to absorb future capital issuance.

There are also issues of culture and investor base to consider. Most Asian and the stronger GCC issuers are highly unlikely to skip calls due to a mixture of local sensibilities and a large local investor base. In an example of the former, the management of a South Korean bank recently told us that a skipped call would effectively break its moral contract with investors (see again Moody’s phrasing regarding debt “being honoured as promised”). In LatAm, where the investor base is more international, the propensity to call is perhaps less strong.

The contractual point is an important one. When investors buy a callable capital instrument, the overwhelming expectation is that it will be called on the first call date. This is why bonds are always priced to the first call date, which explains the slump in price when not called. As long as non-calls are rare, these bonds will continue to be priced to call, penalising investors whose hopes for timely repayment are dashed. While this is not a default, it is a choice made by management. It is a choice which (1) harms investors, (2) increases the bank’s cost of funding, (3) reduces its market access for sub debt and (4) disproportionately affects smaller lenders. While (1) is self-evident, we briefly adduce evidence for the following three points: for (2), the recent decision by BCOLO has pushed the spread to maturity of its Tier 2 bond to 585bps, compared to around 450bps before the call decision and to 293bps for the original five-years term of the security. The credit premium of a theoretical new instrument has thus almost doubled and the effect of worries around the non-call are evident in the bond’s price deterioration throughout 2022 (see chart above). For (3), see the case of Bank Dhofar, which despite its best efforts has been unable to issue any securities since it failed to call its AT1 in 2020. For (4), Bank Dhofar is also a good test case, but we also doubt the ability of Colombian banks generally, and BCOLO in particular, to issue Tier 2 debt at competitive prices following BCOLO’s non-call, not least because they operate in a jurisdiction where bank regulation and operational oversight lag behind regional peers. Itau, by contrast, being a sizeable, stable and well-known issuer, is much more likely to be able to “get away with it”.

All of which brings us to the rating agencies. Non-calls have generated no ratings response. We believe this is wrong. Rating agencies argue that they rate banks on their fundamentals and on their Probability of Default, pointing out (correctly) that a non-call does not legally constitute a default and that sub debt is rated lower than its senior equivalent. However, we would question whether this is the correct approach for bank sub debt, especially in emerging markets. First, we have demonstrated that a non-call weakens an issuer’s credit profile by increasing funding costs and reducing market access specifically for sub debt. Surely this should be reflected in sub debt ratings. Second, we have established that rating agencies exist to provide the market with an impartial judgement of the likelihood of timely repayment. While we agree that a non-call is not legally a default, it is still a choice made by an issuer to withhold funds expected by investors. Surely a bank with a history of non-calls should not have its sub debt rated the same as a bank with a perfect history in this regard? The fact that non-calls are often a management choice rather than a financial necessity make it essential, I believe, to reflect those choices in subordinated debt ratings. It would also make sub debt ratings more credible – the market is well aware of who calls and who doesn’t and will price issuers’ liabilities accordingly.

This final point is important. Perhaps it is we investors who have been mistaken in pricing these securities to call. Granting banks a free option may well not be appropriate. That is for the market to decide. But that does not detract from the central thesis that credit ratings for subordinated debt should reflect previous decisions not to call capital securities if they are to fulfil their stated goal of “address[ing] the possibility that a financial obligation will not be honoured as promised”.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.