Central Asia and the Caucasus – Defying gravity

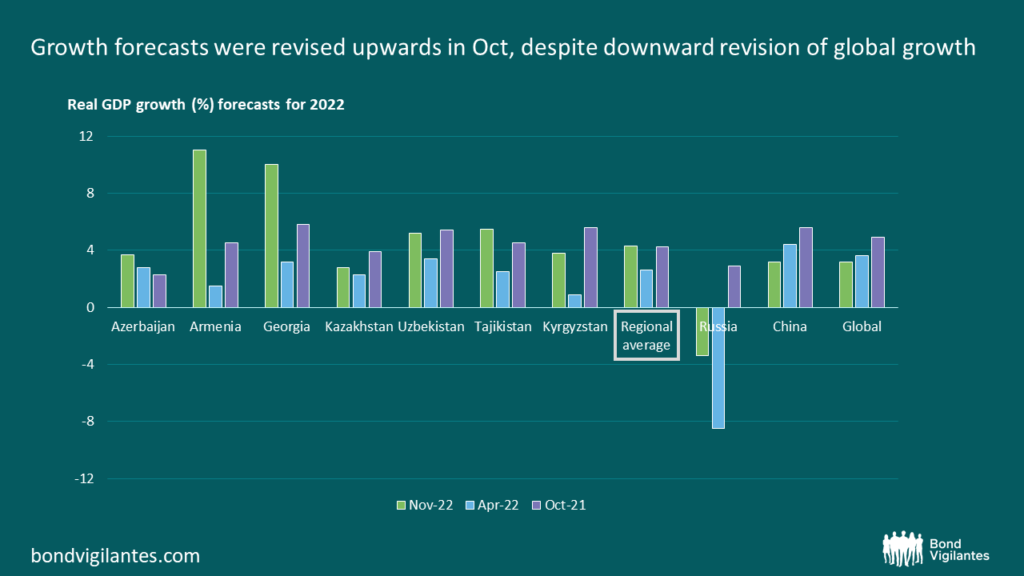

The World Economic Outlook released by the IMF in October has painted a pretty bleak picture for emerging market economies. They have experienced a sharper-than-expected GDP growth slowdown and high inflation amid much tighter global financial conditions and cost-of-living pressures. The 2022 GDP growth forecasts for most advanced and emerging economies have been revised down compared to April, with most notable revisions in China, India, and the US. However, it’s not all doom and gloom across emerging markets. There is at least one region that has done quite well in the current environment – Central Asia and the Caucasus. In a stark contrast to global developments, 2022 GDP growth forecast for this region has been revised significantly upwards to 4.3% (from 2.6% in April), with risks likely tilted to the upside. Moreover, for some of these countries, the fresh 2022 forecasts significantly exceed even those made by the IMF one year ago – when the global economy was in a much better state compared to nowadays.

Source: IMF, M&G (October 2022). Regional average is GDP PPP weighted.

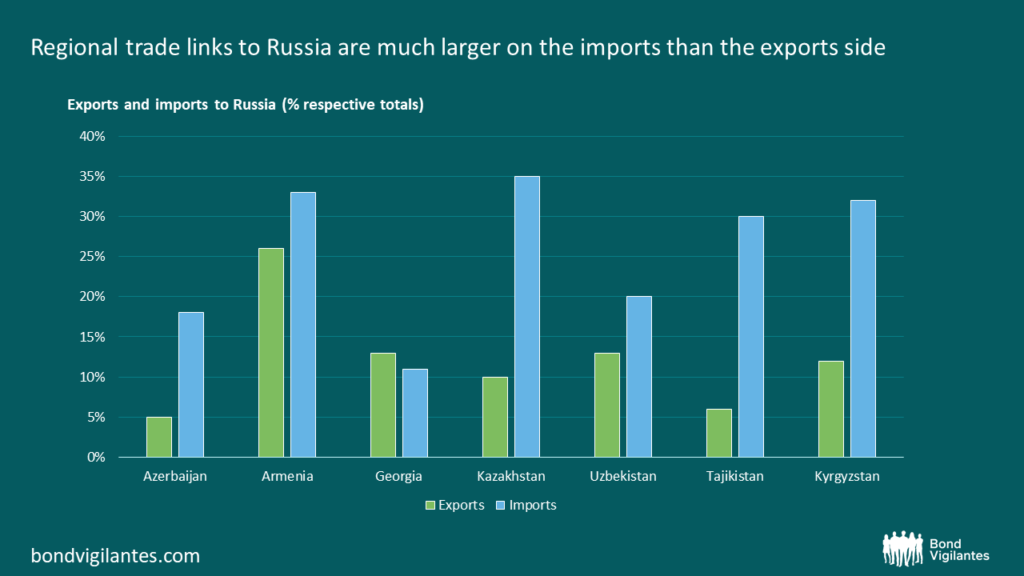

There are some common reasons behind these remarkable positive revisions. The most obvious argument could be that the Russian economy has performed much better than the IMF expected back in April, with the 2022 GDP growth forecast revised to -3.4% from -8.5%. Indeed, Russia is one of the main trading partners for the region, accounting for about 10% of exports and 55% of remittances. However, one should not forget that GDP growth for most other trading partners (including China) was revised downwards in the meantime, likely at least partly negating the positive impact from Russia. At first glance, another reason could be continuously high commodity prices, given the region largely consists of commodity exporters. However, at least for oil price, the IMF has in fact revised down its average 2022 projection from USD107/bbl in April to USD98/bbl in October. Moreover, prices for gold, copper and agricultural products – all, albeit to a different degree, being significant export categories for different countries of the region – have all declined by 15-25% since April. Perhaps the only commodity for which the price has been higher than expected back in spring is natural gas, but it’s an important export category only for Azerbaijan and partially for Kazakhstan (where upward GDP growth revision was very small in fact).

Consequently, the true reasons behind the massive outperformance of the Central Asia and the Caucasus region are likely to be less obvious and more nuanced. Firstly, the region has benefitted from the inflow of migrants (and their money) from Russia, Ukraine and Belarus which boosted domestic demand across the region. Estimating the migrant numbers is far from straightforward (as it’s often difficult to separate them from tourists), but the authorities of each country estimate at least a few tens of thousands of people having arrived with the intention to stay in the medium term. An even larger number of people opened up bank accounts and transferred money to Central Asia and the Caucasus, considering them relatively friendly jurisdictions both for Russia and the West (in the context of Western financial sanctions against Russia). The magnitude of the positive economic impact of the inflow of people and capital has differed across countries, depending on the number of migrants relative to a country’s population size. In this respect, by far the most significant impact has been observed in Georgia and Armenia.

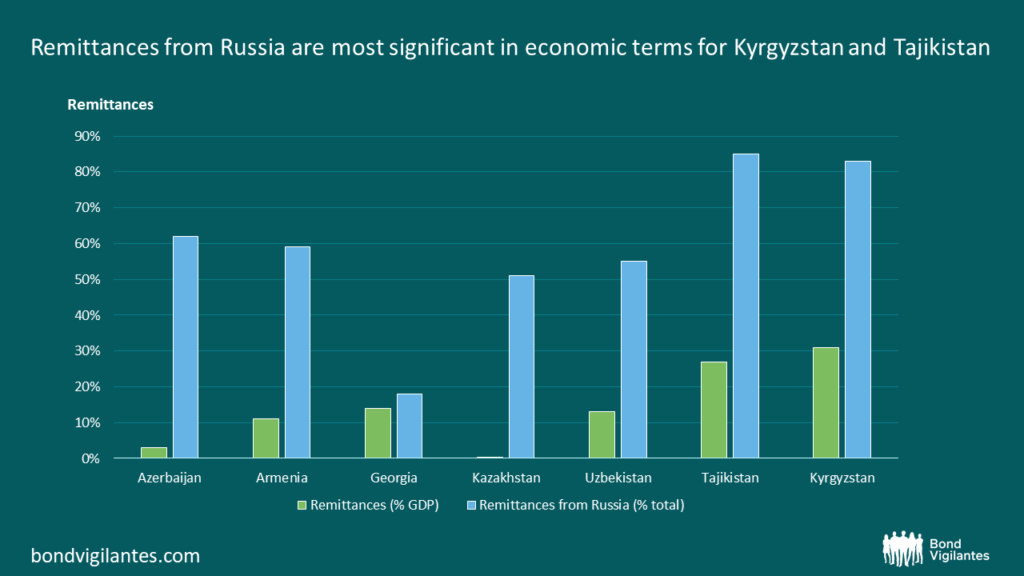

Secondly, remittances from Russia to the region have unexpectedly and significantly increased this year. In some countries (e.g. Georgia and Uzbekistan), reported remittances from Russia have jumped by 75% or more in recent months. This has been in stark contrast to past episodes of recession in Russia, which led to a notable decline in remittances. One explanation might be that this time around the recession has mostly affected the high value-added sectors of the Russian economy (e.g. manufacturing and financial services – against which the harshest sanctions were introduced). Meanwhile, the less technology-intensive and low value-added sectors (e.g. construction and agriculture) – where most migrants tend to work – have stayed resilient, allowing them to keep their jobs. Another possible reason behind the increase in remittances might be the restrictions on hard currency withdrawals from banks in Russia, which prompted some migrants to switch from transferring the remittances in cash (which is difficult to track) to using the banking system instead. Furthermore, after a spike in March, the USDRUB exchange rate has been stronger this year (compared to last year), increasing the value of remittances in USD terms. Last but not least, some of the increase in remittances recorded in the official data might be in fact export receipts or capital inflow.

Source: IMF, M&G (2021 data).

Thirdly, given the trade sanctions on Russia imposed by the West which severely restricted both exports and imports, the Central Asia and the Caucasus region has worked as a partial substitute. Some of the regional exporters have been able to increase their market share in Russia, while importers have also benefited from being able to buy commodities and other goods at lower prices, as the Western markets became largely closed for Russia. One example is Georgia, which has significantly increased its food exports to Russia and oil imports from Russia. In addition, some countries have likely re-exported to Russia some of the goods they imported from the West (which can no longer be exported to Russia directly due to sanctions or logistical reasons). Importantly, while the countries in the region did not join the Western sanctions themselves, they have made an effort to observe them rigorously and avoid becoming targets for any secondary sanctions by the West. This has definitely helped to improve the global investor sentiment towards Central Asia and the Caucasus.

Source: World Bank, M&G (2020 data).

Another factor behind better-than-expected macro performance in Central Asia and the Caucasus has been the faster-than-expected tourism recovery. Tourism is particularly important for the Caucasus, accounting for as much as one-third of GDP in Georgia, and about 13% of GDP in Armenia and Azerbaijan. Tourist revenues slumped dramatically (e.g. by 90% in Georgia) during the pandemic, and the IMF had expected a full recovery to pre-COVID levels only in 2024. Instead, tourist revenues have surprised to the upside this year, reaching pre-pandemic levels already. In particular, the number of tourists from Russia to the region has increased, as almost all European countries suspended flights from Russia and tightened visa regimes. As mentioned above, some of these tourists could actually be longer-term migrants from Russia, Ukraine and Belarus. However, there is also evidence of a substantial increase in tourist arrivals from the Middle East.

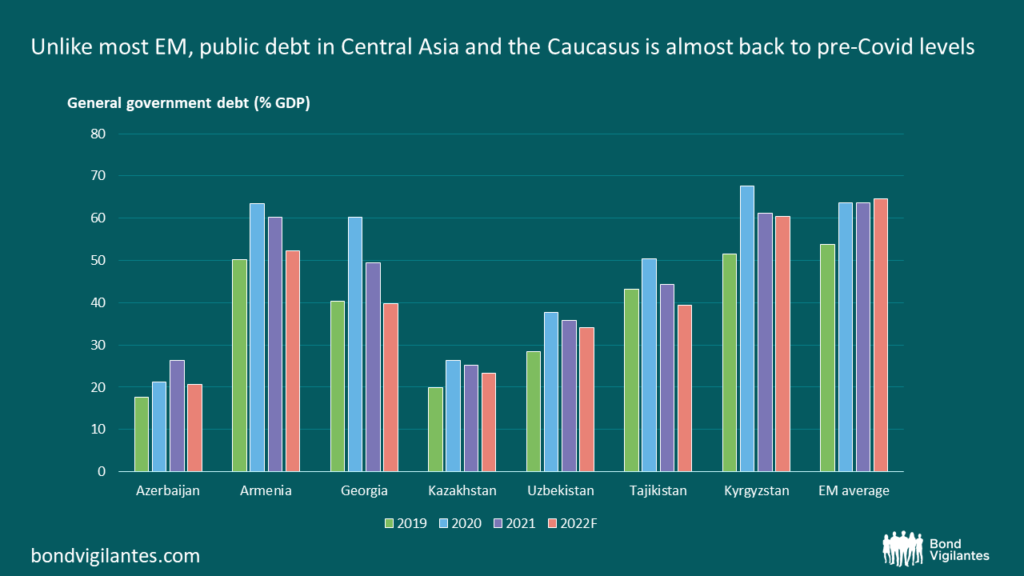

Finally, the IMF perhaps has somewhat underestimated the commitment to the robust policies that the countries of the region continued to implement this year, despite the political pressures associated with the higher cost of living. The majority of countries have continued or rejuvenated their structural reform programmes, often with the support of the IMF itself (Georgia, Armenia) or other IFIs (Uzbekistan). Regional central banks have been mostly pro-active in reacting to inflationary pressures via monetary tightening. In turn, the governments have maintained their resolve regarding post-pandemic fiscal consolidation. Helped also by strong GDP growth and higher inflation, public debt levels across the region have been on a downward trend, already reaching (or being slightly above) pre-pandemic levels. All of the above has supported global investor sentiment towards the region during the challenging environment for emerging markets.

Source: IMF, M&G (October 2022).

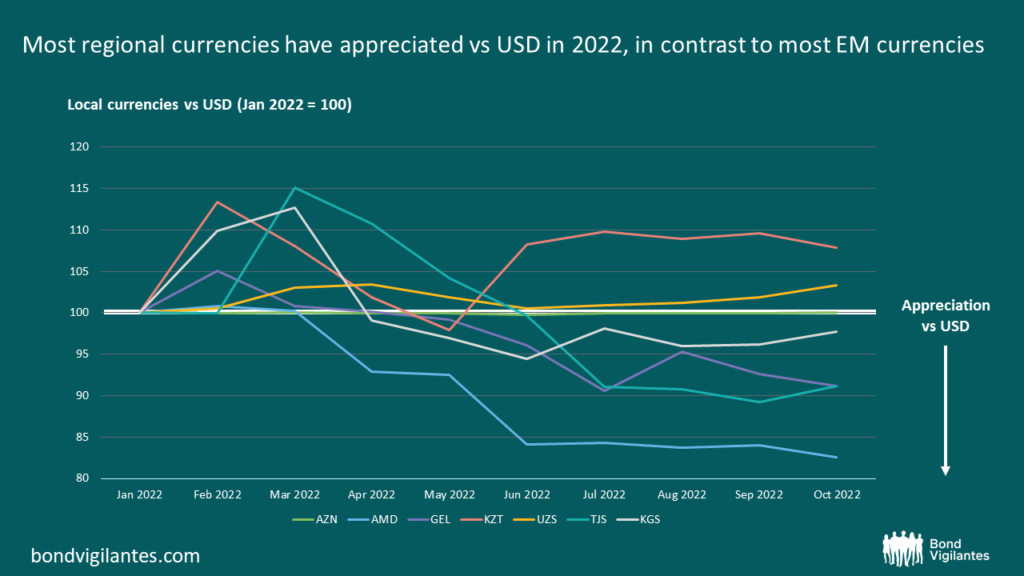

Overall, the remarkably good macro performance by the Central Asia and the Caucasus region has been only partially reflected in the fixed income financial markets. In particular, local currencies have shown remarkable resilience despite the ongoing USD strength in recent months, outperforming EM averages. Georgia, Armenia and Tajikistan are among the very few EM countries that experienced significant local currency appreciation vs USD this year.

Source: Bloomberg, M&G (October 2022).

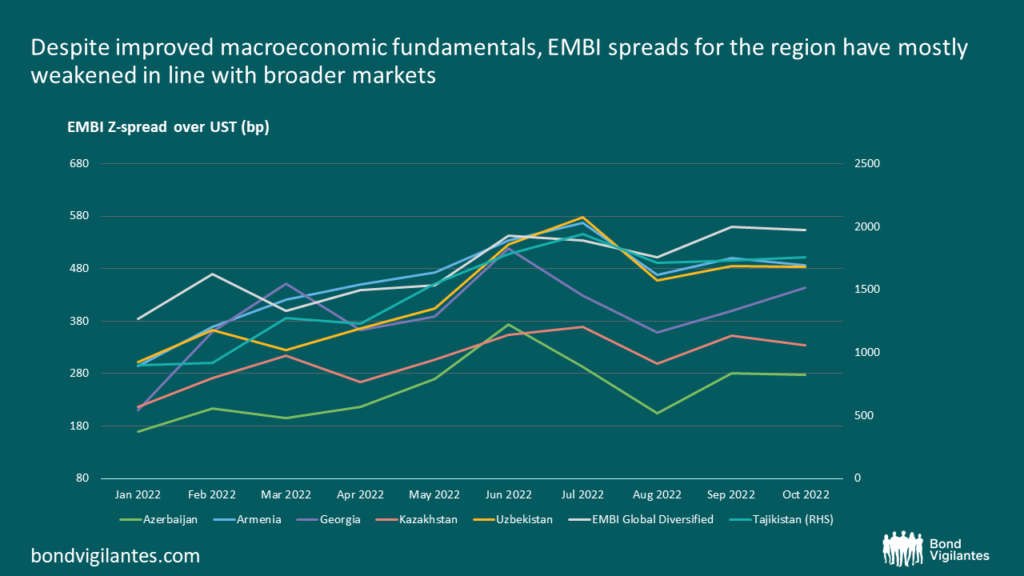

Meanwhile, bonds have not done as well. Shallow local markets suffered from poor liquidity and domestic monetary tightening. Hard currency spreads fell victim to global risk aversion as well as increased perception of geopolitical risks by investors, given the region’s proximity to and dependence on Russia.

Source: Bloomberg, M&G (October 2022).

However, none of these risks has actually materialized so far. Some investors may rightly call into question the durability of the region’s macroeconomic outperformance, given the uncertain outlook for migrant flows in particular. Nevertheless, in our view it is even more important to acknowledge the good economic policies and prudent risk management by the countries’ authorities in an increasingly complex global economic and political environment. With time, this should be eventually reflected in the bond market performance once the global background for EM improves.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.