70 weeks in Tibet: thin air but frontier market resilience

During this Fed hiking cycle emerging markets have been split into two camps. The first group includes sovereigns with investment grade credit ratings, plus the stronger double-Bs (for example, Morocco), whose spreads have not been elevated. They’ve enjoyed market access as and when they need it, albeit at a slightly higher cost than in previous years. The second group includes high-yield emerging markets, a.k.a. the ‘frontier’, who have experienced Himalayan high spreads for well over a year.

This group summited and endured the death-zone, but instead of returning to the green valley, they have instead spent 70 weeks on the Tibetan plateau of high spreads. This has meant being either shut out of the eurobond market, or having been forced to pay well over the odds to refinance eurobonds.

Himalayan high spreads

In July 2022, I wrote about these Himalayan high spreads, at a point when we’d had 22 weeks of prohibitively high indicative borrowing costs – for the purposes of this blog, I have defined the Tibetan Plateau as 9% or higher on a 10-year Eurobond. In June 2023, despite a recent rally, the tally had reached 70 weeks. Eclipsing the 14 weeks spent at altitude in 2020 when the pandemic struck, and even the 43 weeks in 2008 and 2009 as a result of the global financial crisis.

Source: Bloomberg, June 2023.

You see a lot up there but don’t be scared

Despite being in the death-zone, we’ve only had one additional sovereign default since July 2022 – Ghana’s over-borrowing finally caught up with them. Otherwise, there has been incredible resilience up on the plateau.

A number of sovereigns have managed to meet maturities despite the hardships. Survival strategies have included refinancing or buying-back bonds, using foreign exchange reserves (Pakistan and El Salvador), paying over-the-odds to issue (Turkey and Egypt), tendering bonds with no new debt issuance (Mongolia), or by getting the narrative right and issuing at less than astronomic cost (Cost Rica).

Despite the resilience, at these altitudes many sovereigns remain vulnerable. Those looking clearly like they have acute mountain sickness include Tunisia, Pakistan and Egypt. Each have tried to call in the IMF helicopter, but bad weather has meant there has not yet been a proper rescue.

Greener pastures

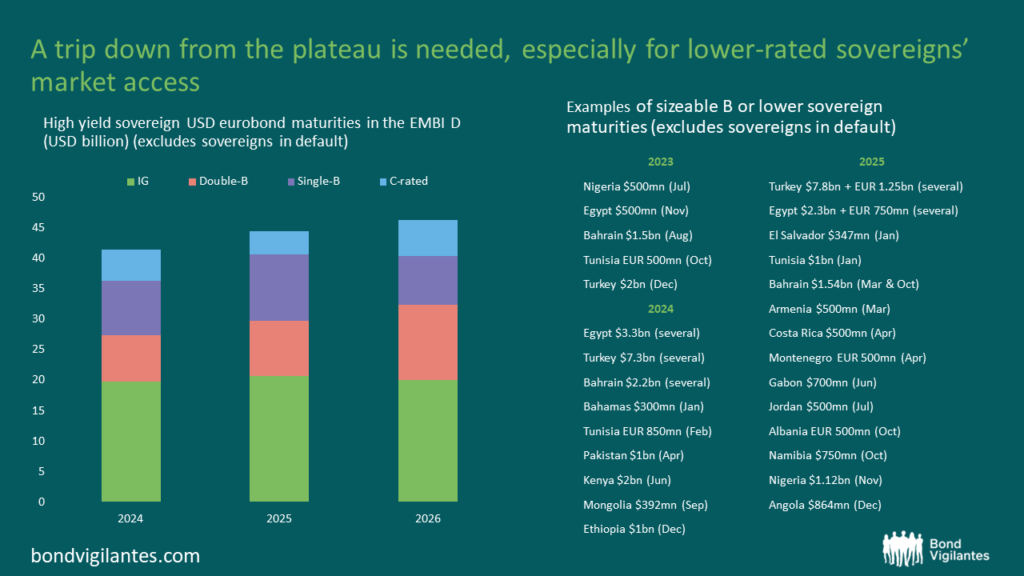

Ultimately, the only way to survive altitude sickness is to descend. More high-yield emerging market bonds will need refinancing in 2024 and 2025. This will require better weather, the Fed ending its hiking cycle and shifting gear towards lower global interest rates. Furthermore, countries that are clearly implementing reforms will have lighter loads and descend much faster.

Source: Bloomberg June 2023.

Summary

70 weeks shouldn’t turn into 7 years in Tibet as cyclical risk-off periods thankfully don’t tend to last that long. Despite the recent hardships many frontier economies remain in good shape. While the descent from plateau will be tricky, there is opportunity in careful selection of those with lighter-loads and for whom the rescue helicopter can land.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.