Emerging Markets debt: 2023 review and 2024 outlook

The beauty of procrastinating writing a year ahead outlook is that you can use more up-to-date assumptions in your forecast. Outlooks from the sell-side (and some buy-side too) started arriving in early-November. Assuming it took them a few days to write, edit and have it approved by compliance, it is possible that some of them were written while US treasuries were yielding close to 5%, about 1% higher than they are now. The massive rally in core rates throughout most developed markets since then begs the question of whether those return targets or views are still valid. The ‘higher for longer’ mantra quickly gave way to expectations of rate cuts from most developed market central banks by mid-2024.

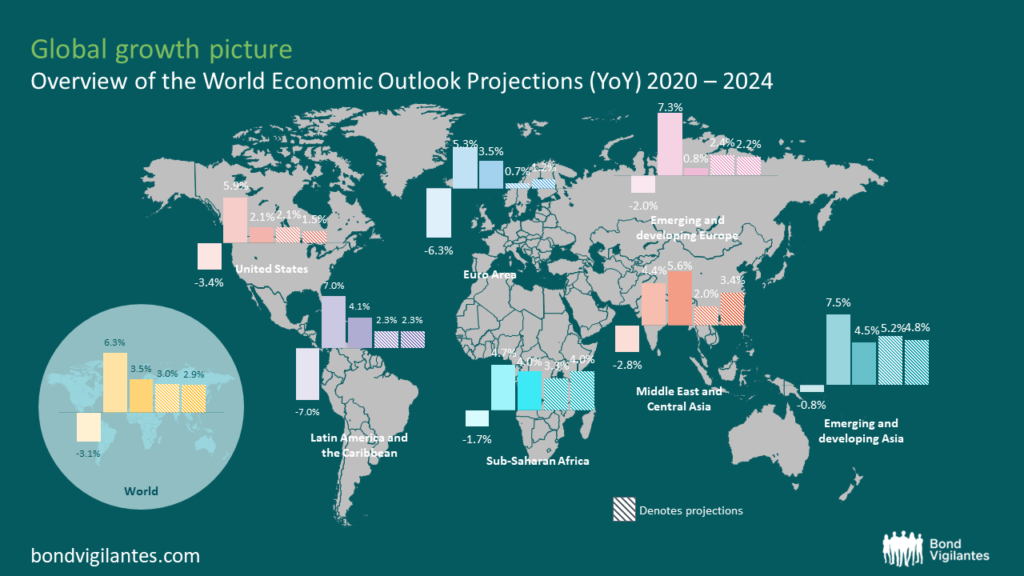

The base case macroeconomic scenario for 2024 is favourable as inflation has receded in most economies, central banks have been or will soon be easing policy, and growth, while expected to slow down, may avert a recession. Having said that, this has pretty much been priced in by the markets and stickier inflation could lead central banks to cut far less than that which is priced in (over 100 bps of cuts in the US). This would lead to a backup on rates or a deeper economic slowdown that could lead to widening of spreads and lower equities, but a further rally in core rates.

Note: Order of bars for each group indicates (left to right): 2020, 2021 and 2022 actual, 2023 and 2024 projections

Information is subject to change and is not a guarantee of future results.

Source: M&G, IMF World Economic Outlook , October 2023 (latest data available).

Noteworthy elections include Indonesia, South Africa, Mexico, India and, of course, the US. Elections often produce volatility and investment opportunities and do not necessarily reflect downside risks. In fact, recent elections in Turkey, Poland and Argentina all led to a subsequent rally in asset prices on back of outcomes that led to improvements in economic policy making. Meanwhile, key geopolitical issues (Russia-Ukraine, Middle East and China-Taiwan) remain unresolved and the US elections are not helping to ease the uncertainty on this front.

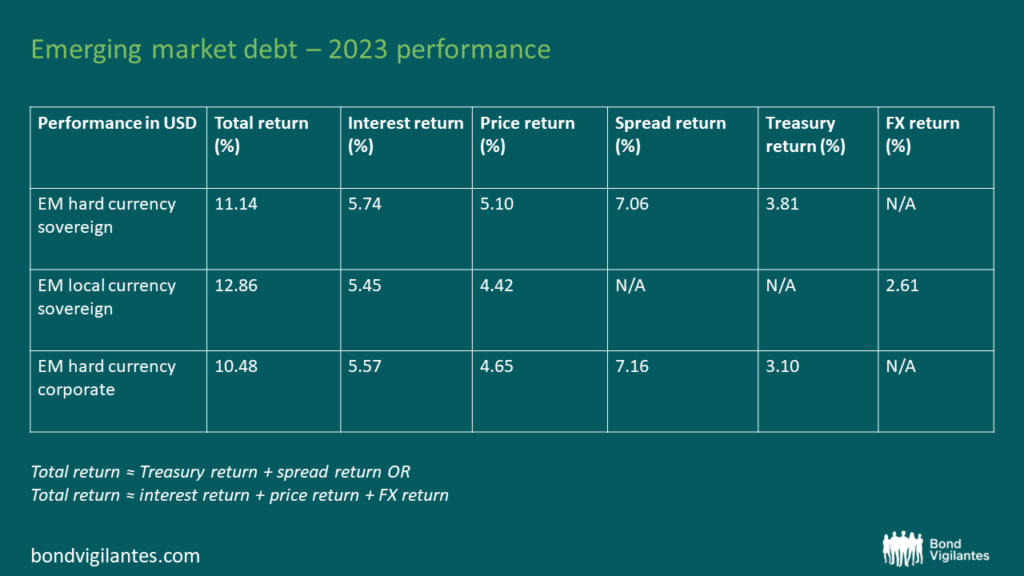

We expect 2024 return drivers to be different to those in 2023

Source: JPMorgan, Bloomberg (29 December 2023)

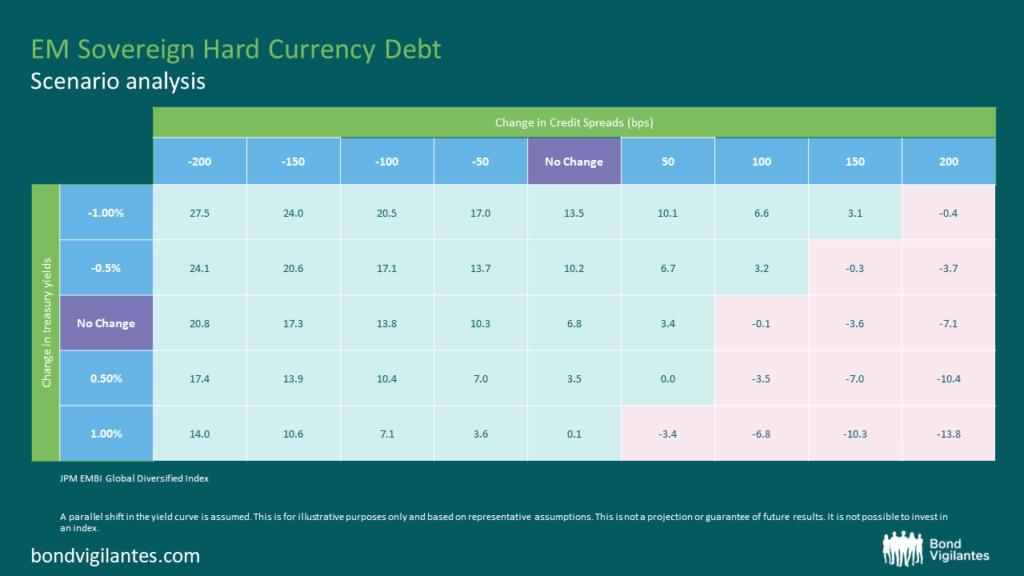

In sovereign hard currency, the outsized 2023 returns of high yield and distressed credits (for example, Venezuela, El Salvador, Pakistan and Sri Lanka, all returning between 70-150%!) will not be repeated as bond prices have reached the 60-80+ price range. Similar future returns would bring those bonds near par – levels consistent with BB credits, which they are far from. In fact, there were 15 countries that posted total returns above 15% for the year. Conversely, there are just a handful of issuers that have performed very poorly in 2023 (Bolivia and Ecuador), which limits the number of distressed credits that could return 50%+ or more in 2024. Therefore, we expect carry to take a larger role in 2024 returns as opposed to price appreciation.

A supportive factor is that many of the single B and below rated countries are trading now at single digit yields, meaning that they will have once again market access. Following a year where only one sovereign default occurred (Ethiopia), we may see a small number once again (Bolivia perhaps?), should current economic policies remain unchanged. It was also encouraging that Suriname managed to restructure its commercial debt and Eurobonds, with progress in other countries, namely Zambia, Sri Lanka and Ghana being much slower. Investment grade credits present limited opportunity for spread tightening, given that those are at multi-year tights, and whose scope for outperformance vs the high yield space will be mainly driven by US Treasuries.

Source: JPMorgan, M&G, (29 December 2023)

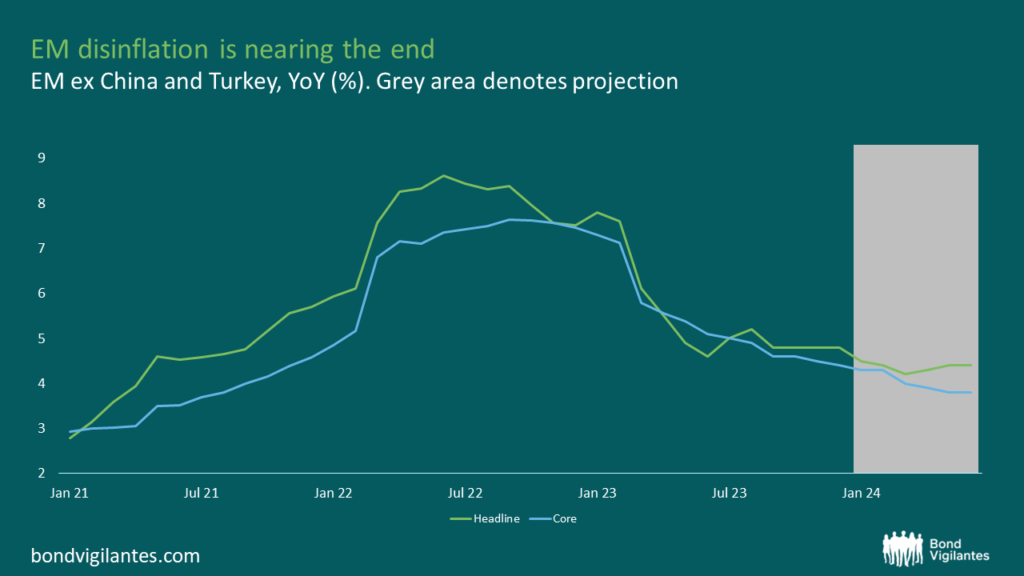

Local yields saw the continuation of disinflation. For 2024, we expect the disinflation to slow as the key drivers fail to assist to the level that they did in 2023. For example, energy and food prices are unlikely to help as much as they did last year with service inflation being stickier at current levels. With most markets pricing in a range of -100 to over -400 bps in rate cuts, opportunities will be more selective and data dependent as opposed to the widespread rates rally we saw in 2023.

Still, even on a carry basis, we find plenty of attractive opportunities. For example, most local yields underperformed the recent rally of US Treasuries. Mexican local Bonos, which tend to be highly correlated with US yields given the close link between the two economies, not only yields over 5% above comparable US Treasuries now, but with less historical yield volatility given US Treasury volatility was very high over the past 6 months. In fact, it is quite remarkable that 10 year US Treasuries ended the year at 3.9%, almost exactly where they were at the beginning of the year, despite the very large moves we saw in the second half of the year. With both countries facing elections in 2024, I would argue that calling the US election and its subsequent policy stance is harder than calling Mexico’s.

Source: JPMorgan (December 2023)

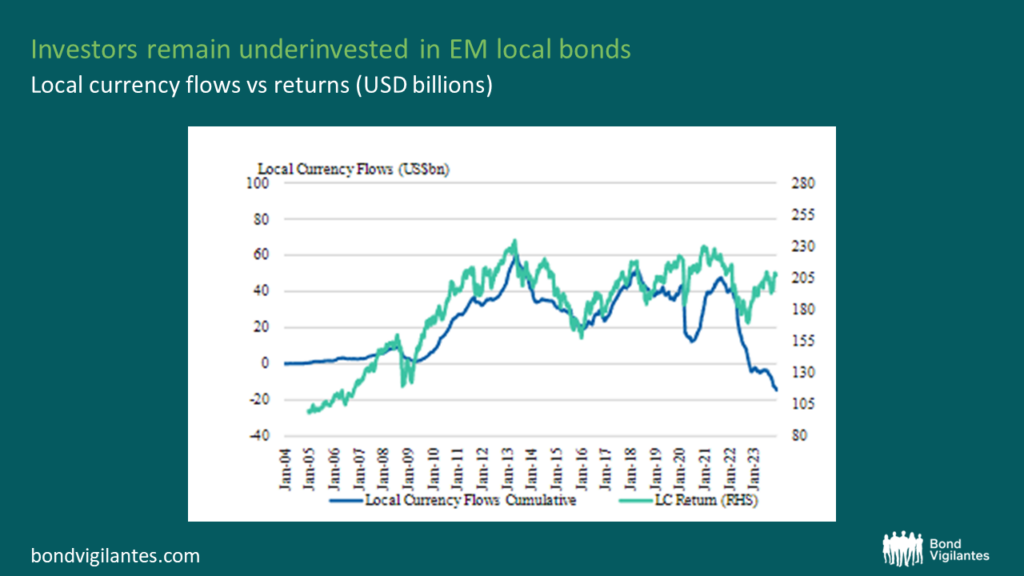

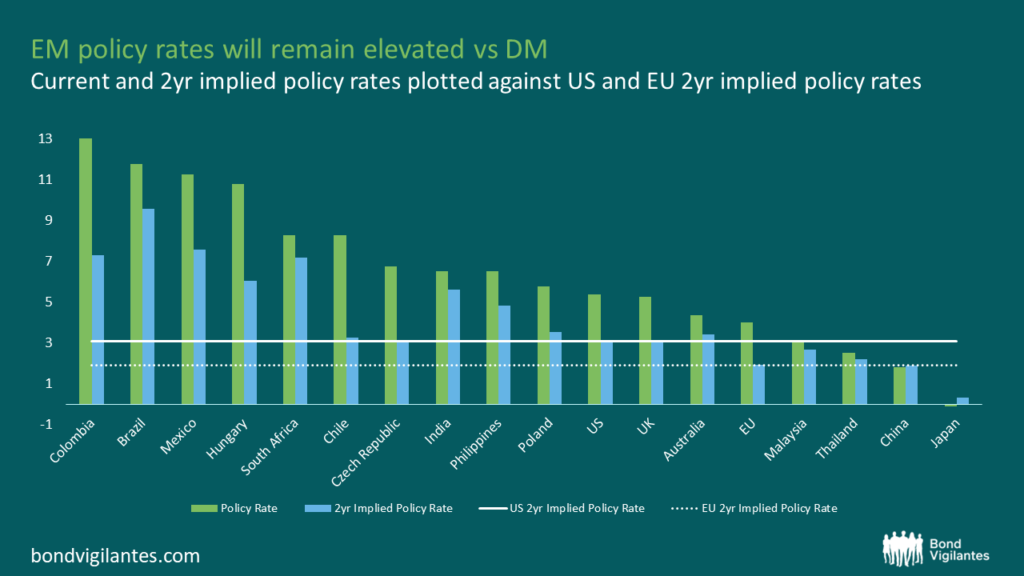

We remain selectively constructive on EM currencies, as we do not expect the US growth to outperform EM growth or on its monetary policy trajectory (i.e. additional tightening). Valuations are generally not expensive, with the exception of a few currencies such as the Mexican Peso or Czech Koruna. Finally, investors seem to be underinvested in EM local bonds (see graph below), which faced stiff competition from high short term rates in the US, UK and Eurozone. That should improve going forward as those central banks start easing and short term rates decline (see second graph below). There is often a lag between positive returns and inflows – i.e. investors often chase returns, not anticipate them – and higher capital inflows are supportive for the currencies and/or for the accumulation of international reserves, which is credit positive.

Source: EPFR, Bloomberg, Morgan Stanley Research

Source: Bloomberg, M&G (29 December 2023) *2 year bonds or closest available maturity

Conclusion

While the double-digit returns we saw in 2023 may not be replicated again in 2024, emerging market debt still offers compelling opportunities, especially for investors that are facing the reinvestment risk from short-dated bonds. Even if returns converge to average (mid-to-high single digits), the asset class should not be overlooked.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.