Emerging markets high yield post-mortem

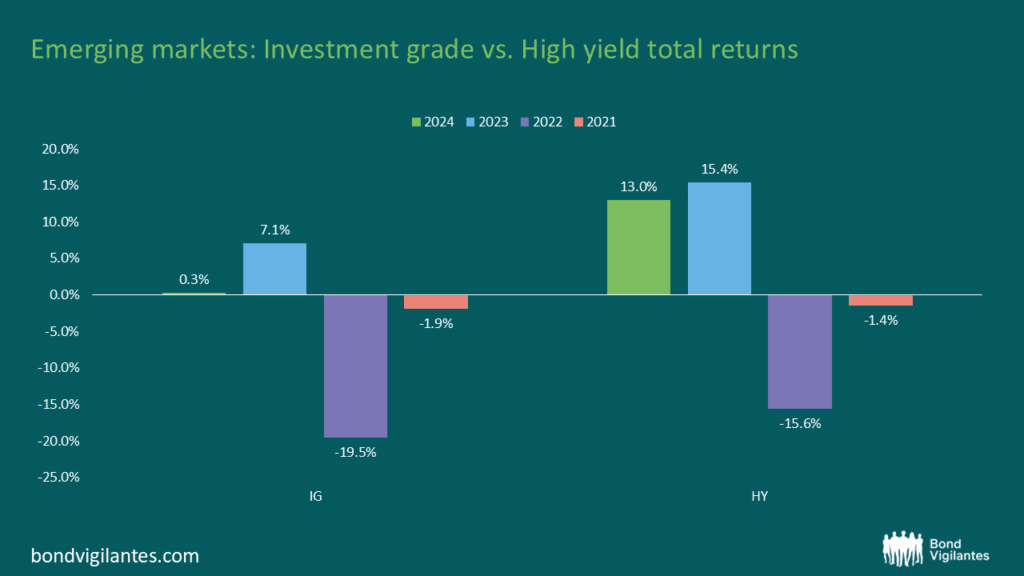

Emerging market (EM) high yield (HY) sovereigns have had a rip-roaring year: in 2024, they outperformed EM investment grade (IG) sovereigns by 12.7%, the most since 2015 (12.5%). What’s more is that this outperformance was founded on significant market-friendly reforms bearing fruit. These included recent moves to end FX distortions[1], tight/er monetary policies, sustained spending consolidation, and, in some cases, the emergence from long-winded debt restructurings[2].

Such reforms, coupled with attractive valuations, created promising opportunities for investors, especially in the distressed space. In addition there were no defaults in 2024 – a fact that is also likely to remain true in 2025.

Source: JP Morgan, Bloomberg

To be sure, the start of the global rate cutting cycle also provided a “push” factor, but, given that long-end US Treasury yields remain high, the cuts did not result in a material fall in the cost of financing for frontier/distressed sovereigns, market access for whom was still only possible at yields north of 10%. Arguably, it was the “pull” factor that dominated the investment rationale for HY/Frontier Market (FM) space in 2024. Moreover, HY outperformance has also occurred amidst continued outflows from EM as an asset class during the last 3 years, moderating commodity prices, and a spate of elections, a few of which led to pretty consequential regime changes (think South Africa, Sri Lanka, Ghana).

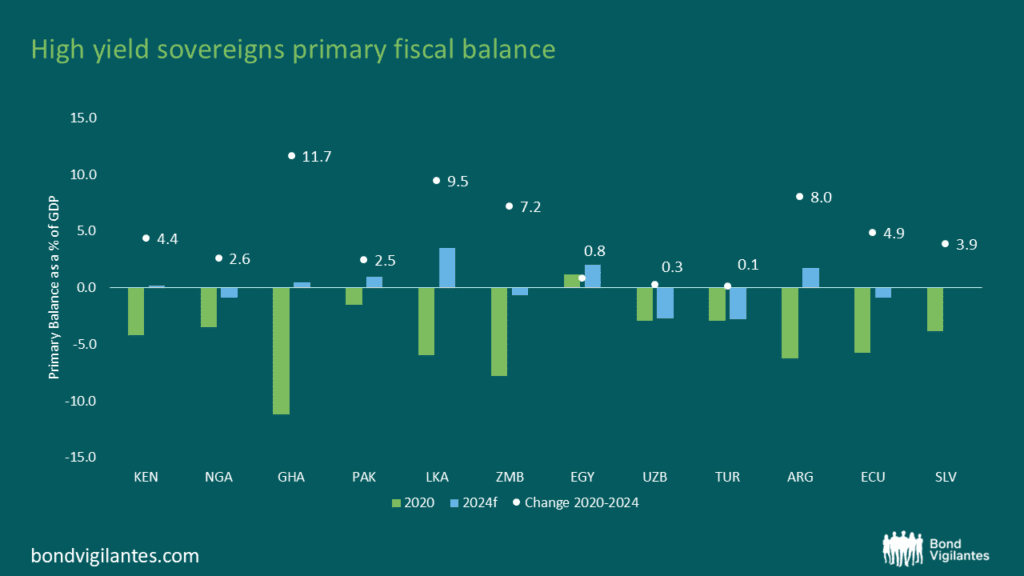

Interestingly, as the ever cogent David Lubin notes in this recent blog for the IMF[3], the reform effort has been concentrated in the most fragile economies, or those at the bottom of the rating scale. It is noteworthy how these sovereigns, although beleaguered by ballooning interest bills, or perhaps because of them, have been tightening primary spending in the last few years.

Source: IMF, Bloomberg

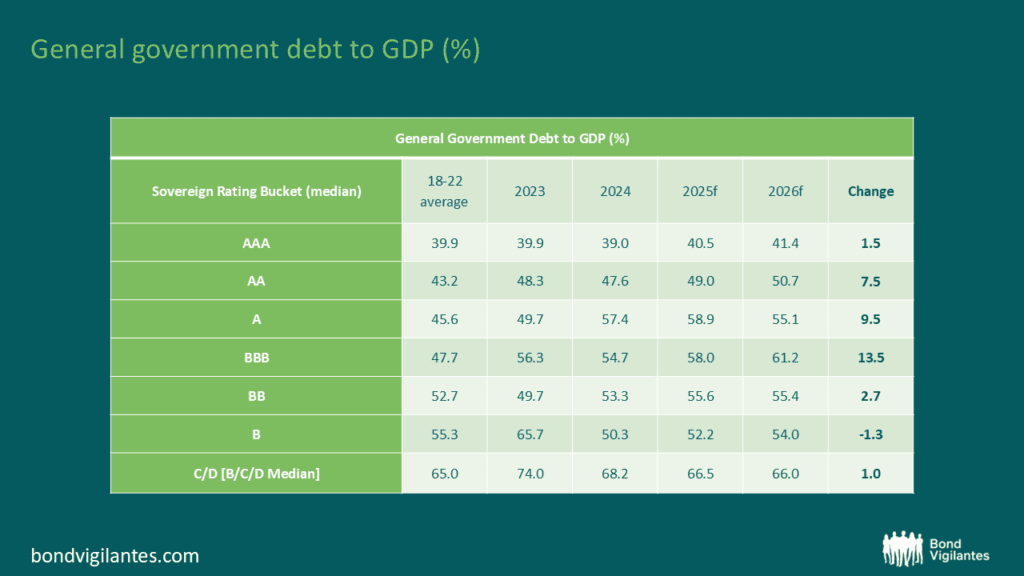

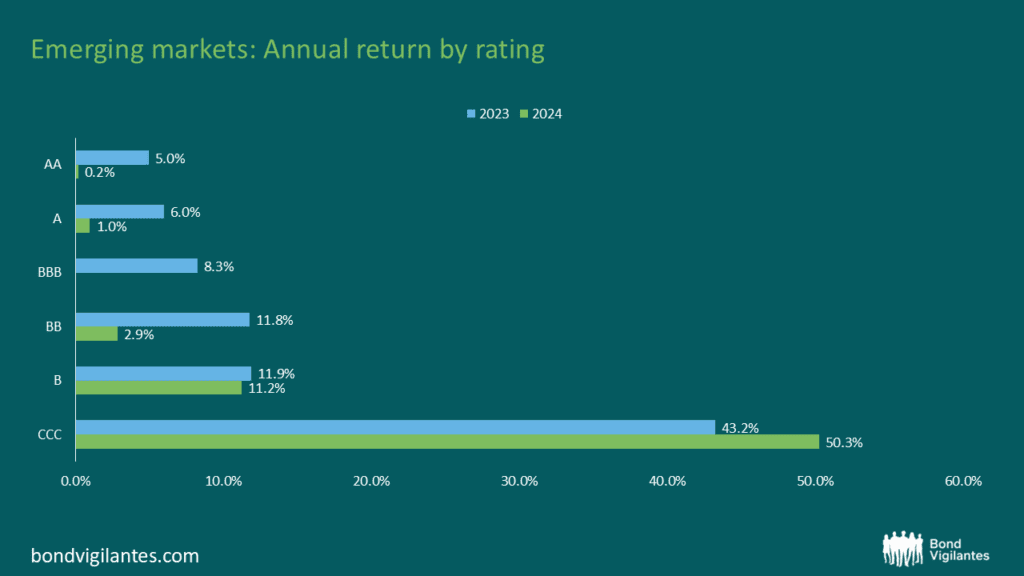

By contrast, several middle-income EM sovereigns have seen their balance sheets deteriorate. Indeed, some “core” EMs (think Brazil, Mexico, Poland, Thailand), most of which can borrow predominantly in their own currency, are availing of this privilege to increase spending and shore up domestic demand in the face of rising global uncertainty. As this table of general government debt to GDP from Fitch shows, debt is on course to stabilise in the lowest-rated sovereigns but is forecast to rise in all the others, most noticeably in the BBBs – a divergence that is also visible in performance.

Source: Fitch Ratings

Source: JP Morgan, Bloomberg

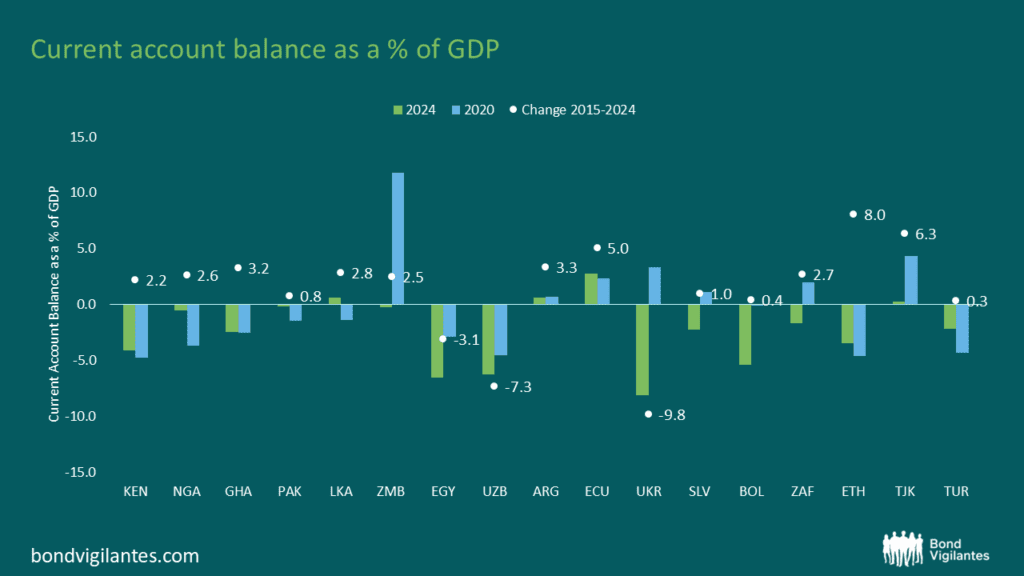

Meanwhile, current accounts have improved pretty much across the board in EM over the last decade, suggesting an improved capacity to manage external flows. A part of the reason fundamentals in the HY segment have improved is that several of these sovereigns have a policy anchor in the form of an IMF programme. Indeed, Morgan Stanley notes that a total of 29 countries in the EMBIGD index, representing 27% of the index in weight terms, are in an IMF programme – the highest since 2010[4].

Source: IMF, Bloomberg

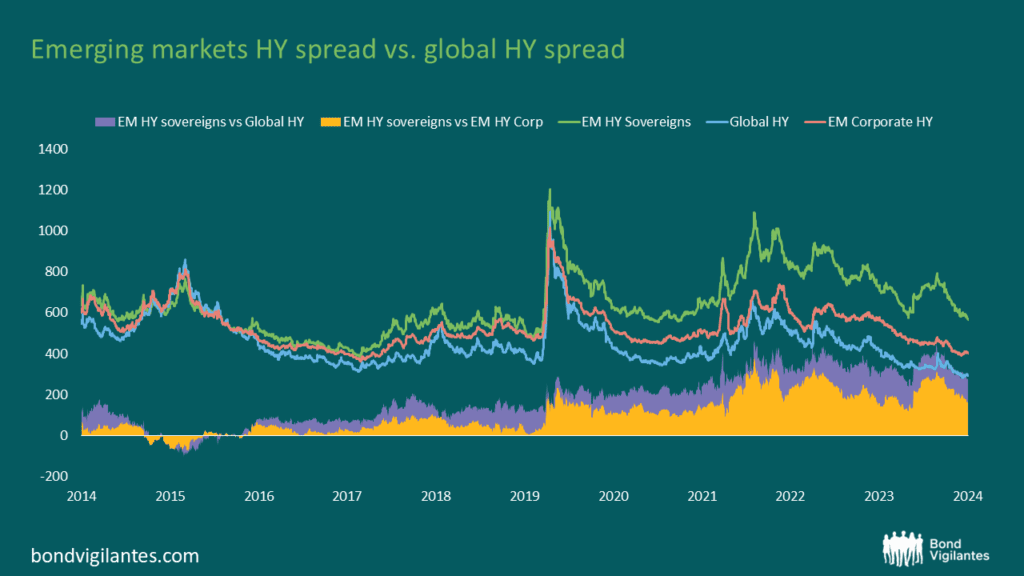

Improving fundamentals aside, the other necessary condition for a rally of this magnitude is a beneficial starting point, i.e. attractive valuations. Given the wave of sovereign defaults over 2020-2022, EM HY sovereign spreads were wide relative to history at the beginning of 2024, despite starting to compress in 2023. Moreover, they were wide not only in absolute terms, but also relative to Global HY and EM HY corporates. It was this relative attractiveness that helped drive the rally by drawing in non-dedicated EM, fast money, and crossover buyers to an asset class otherwise beset by outflows.

Source: ICE HY indices, JP Morgan, Bloomberg, as at 16th December 2024

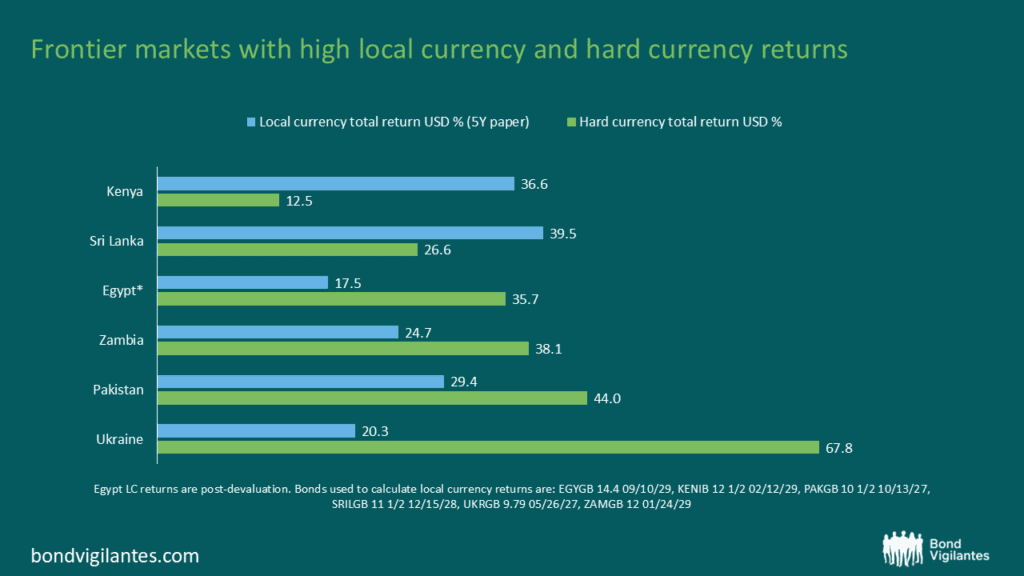

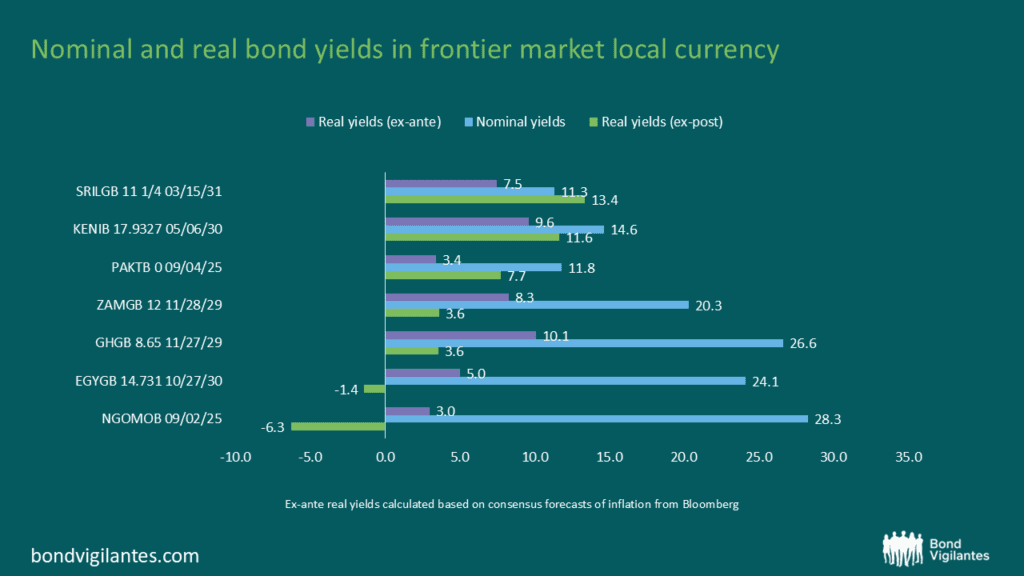

In fact, a handful of the best performing frontier market (FM)[5]/distressed sovereigns in the hard currency (HC) space were also able to attract external capital into their local currency (LC) debt markets where valuations were equally, if not often more, compelling than in HC. One could argue that the dislocations created by sizeable FX depreciations/devaluations, with follow-on hikes in nominal interest rates to 20-30-40% to contend with the inevitably painful spike in inflation that results from such FX moves, were too good to pass up. This was especially true where monetary and fiscal policy tightening were in sync, creating the perfect preconditions for disinflationary forces to take hold further down the road, and for rates to retrace from prohibitive to more normal levels thereafter. Those that were able and/or brave enough to venture into FM LC were rewarded handsomely.

Source: JP Morgan, Bloomberg, Citi, as at 16th December 2024

Interestingly, this promise of outsized capital appreciation, on top of the high carry in FM local currency markets, meant that they were able to attract inflows at a time when flows to the traditional EM local currency markets, where valuations have been attractive for several years, were still languishing (see Claudia’s blog for more colour on developments in core EM LC markets). In addition, while the 2024 investment thesis for local currency in GBI-EM constituents was premised in part on the positive impact of the global easing cycle on EM FX via a weaker USD, something that did not, in the end, materialise, the FX channel was much less significant in FMs seeing as so many of them were coming out the other end of an already massive fall in their FX. Indeed, FMs with cheap FX and solid macro-fiscal outcomes, saw their currencies appreciate in the face of USD strength. The Kenyan Shilling (+21%) and Sri Lankan Rupee (+10.5%) were the top two best performing currencies globally (in spot terms)! Frontier local currency debt is one segment of the HY EM universe that still holds pockets of value going into 2025, as hard currency spreads have tightened considerably over the last 12 months (although yields do remain high in absolute terms, making HC a carry play). It is literally the last frontier because there aren’t many other places left to go!

Source: Bloomberg

[1] Countries that saw large devaluations or depreciations over 2023-24 include Egypt, Nigeria, Ethiopia, Kenya, Argentina, Turkey, Pakistan, Angola, Zambia and Ghana. Sri Lanka saw a large devaluation in 2022

[2] Ghana, Zambia, Sri Lanka, and Ukraine all successfully concluded debt restructurings in 2024

[3] Emerging Markets’ Two-Way Traffic

[4] EM Sovereign Credit Strategy: Funding Pressure and Opportunities

[5] Loosely speaking the Frontier markets sovereign universe is defined as those that populate JP Morgan’s NexGEM Index

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.