Brazil’s election: What’s at stake?

Global investors are paying special attention to the forthcoming general election in Brazil, not only because the country is the world’s eighth-largest economy, ahead of Italy and Canada, but also because in these turbulent times for Emerging Markets (EMs), an unexpected or market-unfriendly outcome could bring more volatility to the entire asset class. After the recent sell-offs in Turkey and Argentina, the EM space is delicate and could be especially sensitive to what happens in Latin America’s No. 1 economy. So, what’s happening?

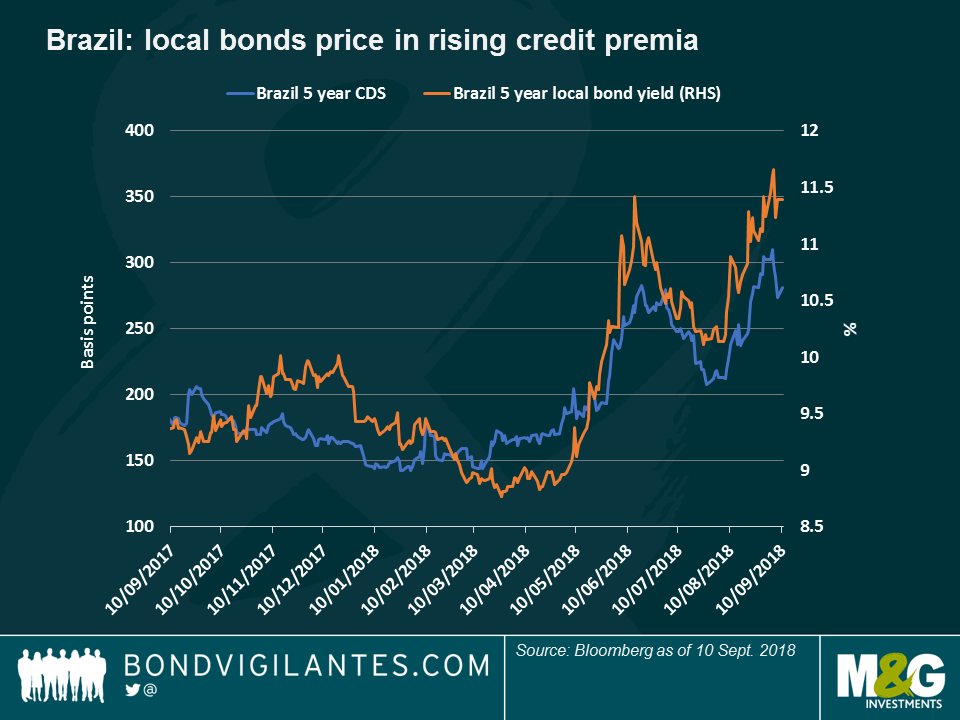

The election recently took a sharp turn after the stabbing of presidential candidate Bolsonaro, who is now recovering and will continue to run. The dramatic event, though, led to a rally of Brazilian assets as investors started to price in that the far-right leader may now have more chances to win. The positive reaction came not so much because investors favour his views, but because he may now get some sympathy votes, reducing the popularity of extreme left leaders – generally more disliked by markets. As seen on the chart, the real strengthened and the cost to protect sovereign debt against default (CDS) cheapened following the Bolsonaro attack, and also after a court ruled that former left-wing president Lula, now in jail, could not run.

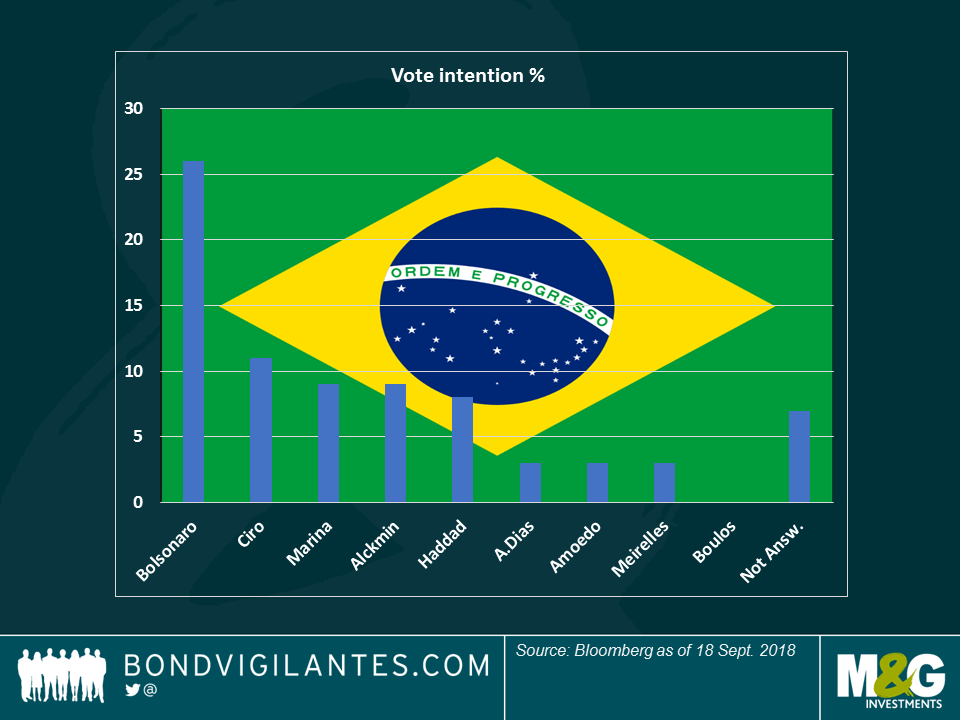

Bolsonaro was already Brazil’s front-runner before the attack, but his share in the polls rose to 26%, from 22%, afterwards, according to the latest polls, from Sept. 10. As seen on the chart below, he is followed by Ciro Gomes, a populist who has questioned central bank independence, and market-friendly candidate Geraldo Alckmin, who is levelled with Marina, a centre-left leader.

However, ranks could change with Lula out of the race. Some of his votes may go to the Workers Party (PT) candidate Fernando Haddad, or to Marina, or even become blank, in protest. This distribution could even things out, increasing the chances of a centrist victory – and the possibility that Alckmin makes it through the first round on Oct. 7. Some now predict that Alckmin may face Bolsonaro in the second and final round on Oct. 28.

Financial markets may welcome either of those candidates, especially Alckmin, although in my view, investors may not be totally pricing in the former São Paulo governor’s chances to implement the reforms he is proposing: with an unruly and highly fragmented Congress, Alckmin’s prudent fiscal and social security approach may be difficult to achieve.

Investors also seem more open to a Bolsonaro presidency than they seemed in the past: This has become more prevalent as some of his advisors have reiterated plans to privatise state assets, including crown jewel Petroleo Brasileiro SA (Petrobras) or lender Banco do Brazil. Asset sales, Bolsonaro’s team argues, should cut the country’s soaring debt (the government’s total gross debt to GDP reached 74% last year, up from 51% in 2011). However, markets may also be a bit ahead of themselves when assessing Bolsonaro, as he has not been as keen on privatisations in the past: the former army captain has publicly praised the nationalist, state-driven policies of the country’s military government in the 1970s.

But if the Bolsonaro vs Alckmin prediction is wrong and politically-fatigued Brazilians choose a non-centrist, left-wing candidate such as Gomes, then we could expect a large repricing of CDS and further real weakness. In such case, we could expect Banco Central do Brazil to use its large firepower to smooth a potential depreciation. Apart from buying reals to support the currency, we could see the central bank increase Foreign Exchange swap auctions, if needed.

Finally, and in terms of rates, we have seen local government bond yields rising to price over 300 basis points in rate hikes for the next 12 months – perhaps this is a parallel bearish move upwards reflecting recent CDS moves, as seen in the chart below.

The Brazilian election race has just started: stay with us – we will come back with more comments as events unfold. For more, click here to see a chart of how Brazil’s growth and inflation fared under the last four presidencies.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox