Bond Vigilantes Weekly: 2016 all over again?

Global bond markets rallied after the US Federal Reserve (Fed) signalled on Wednesday what financial markets had been pricing in for months: the central bank will most likely retract from its rate hiking plans this year, given the global economic slowdown, lower oil prices and generally muted domestic inflation. The Fed also indicated its balance sheet may not shrink as much as expected as it needs reserves to meet rising demand from national banks (required to own more Treasuries to strengthen their coffers). This dovish-squared message reminded investors of 2016, when previous Fed chair Janet Yellen was on course to start normalising rates 8 years after the financial crisis, but refrained from doing so, providing a favourable backdrop for risk assets (more below).

US inflation-linked securities rallied as the absence of higher rates may stoke inflation, while the US High Yield (HY) spread over Treasuries has now plunged to 430 basis points (bps), down from 537 bps earlier this year. Emerging Market (EM) currencies flew as the dollar fell: the Indonesian rupiah rallied more than 1% yesterday as the country embarked on defensive interest rate hikes last year to protect its currency while the Fed was raising rates, so investors are now speculating that rate cuts this year are possible. Sovereign bonds also outperformed, with the Treasury 10-year yield falling back to 2.66%, down from 2.78% only last week. Oil gained.

Heading up:

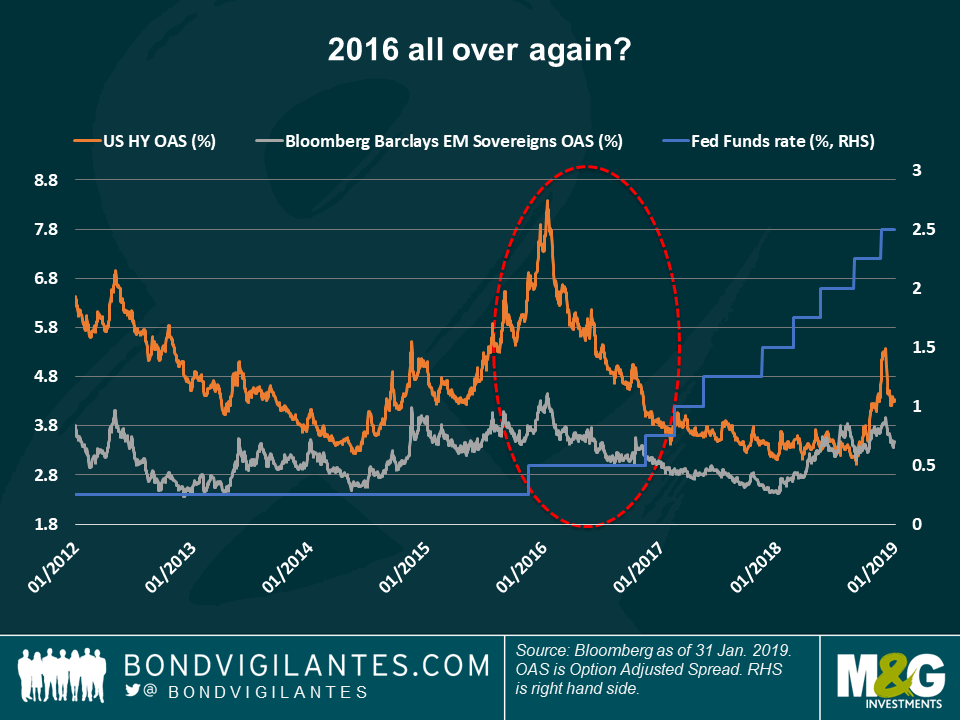

Markets beat the Fed – again: Over the past five years, investors have challenged the Fed’s optimistic growth and inflation forecasts, pricing in a much lower probability of monetary tightening than the central bank. Every year they have been right;, US inflation has failed to gain real traction and as last year’s tax cut-fuelled growth is starting to wear off. This is not the first time that the Fed backtracks on its plans: in 2016, Yellen was planning a few hikes after lifting interest rates in December 2015 – the first hike since 2006. The Fed, however, had to shift gears as the Brexit referendum, plunging oil prices, tensions around the liquidity of a major European bank and a slowdown in China threatened global growth and kept inflation subdued. The same pattern seems to be now at play: low energy prices, a slowdown in China and tensions in Europe (still Brexit). Investors were quick yesterday to snap up risk assets, given their reaction to a Fed-on-hold in 2016: as seen in the chart, HY spreads tightened by 400 bps in 2016, while the premium that investors demand to hold EM sovereign debt also dropped. Spread levels are lower now, but some investors believe that the higher coupon typically offered by risk assets could deliver positive total returns in the absence of any price drop derived from a rising base rate.

HY: Fixed or Floating? Global floating rate HY debt performed better than fixed-rate HY over the past six trading days as some investors were still counting on the Fed to hike rates this year. Whether this will now change following Wednesday’s statement is yet to be seen, as plenty of challenges remain – geopolitical tensions or an escalation of global trade wars could lead to higher rates, an environment in which floating debt typically outperforms. Investors might also choose the lower-beta floating rate market if the economy deteriorates more than expected. For an analysis of the two assets classes and a simulation of how each responds to interest rate and spread changes, don’t miss M&G fund manager James Tomlins’ insightful blog: High Yield in 2019 – floating or fixed?

Heading down:

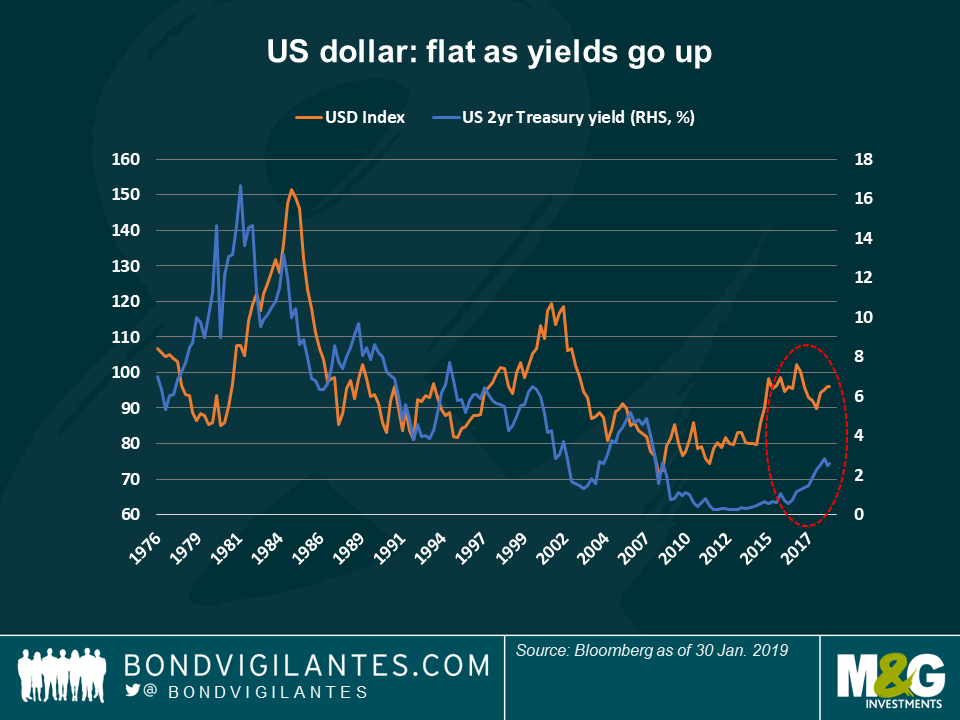

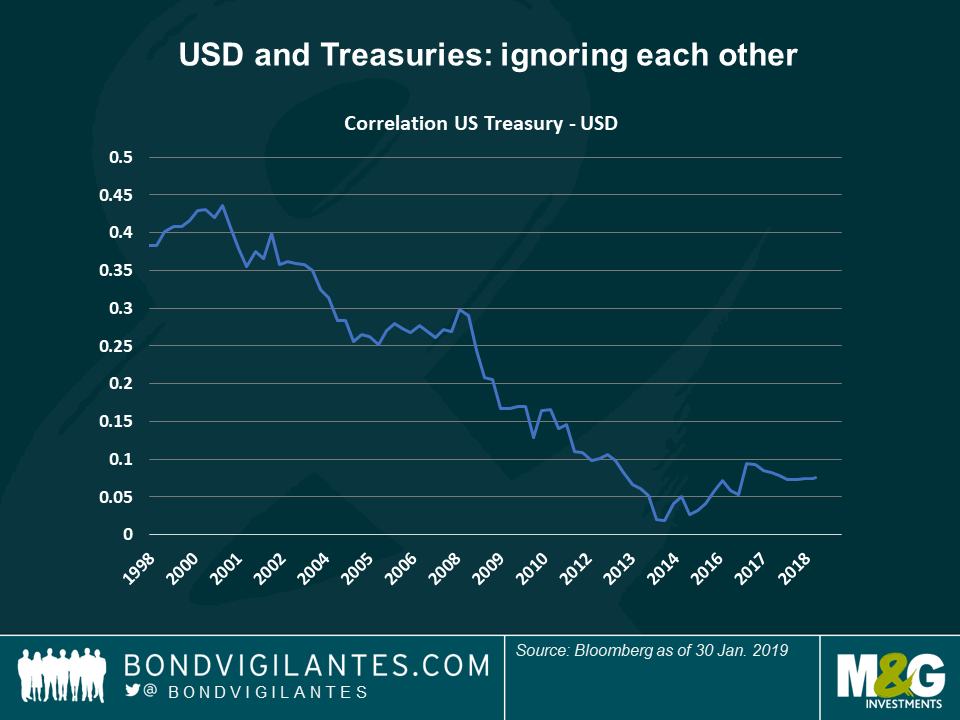

US dollar and US yields – parting ways: The correlation between the US dollar and 2-year Treasury yields has plunged to almost meaningless levels, after being at a stronger 0.45 (out of a maximum of 1) in the early 2000s – it has declined ever since. As seen in the first chart, the relationship between the two seems to have broken down over the past three years, as 2-year Treasury yields (blue line) have risen, reflecting strong economic growth, but the dollar (orange line) has not matched this move, remaining relatively around the same level. The US currency has failed to mirror the improving domestic economy, dragged down by growing fiscal and external deficits and also as China’s renminbi is challenging the greenback’s world supremacy status. Willing to internationalise its currency, China is encouraging other countries to write commodity contracts in renminbi and also lending large amounts to Asian and African countries in its currency. Some investors argue this challenge will still take years to materialise, while others focus on the lower demand for US assets from China and Japan, whose holdings of US Treasuries are in decline given the presently high hedging costs (a consequence of the big interest rate differential). If the US dollar, largely determined by foreign demand, is not matching US economic moves – does this mean that the rest of the world is less responsive to what is happening in the US?

European inflation expectations – party pooper: In the midst of January’s risk-on optimism, the one indicator that keeps falling is European inflation expectations, which dropped to 1.495% on Wednesday, the lowest level since 2016. European economic data remains dismal, with Germany’s economic ministry cutting the country’s growth forecast for this year to 1.0%, down from a previous 1.8%. With France’s economy challenged by ongoing protests, Italy’s protracted fight with Brussels over its budget deficit, and the possibility of a disorderly Brexit still on the cards, few investors seem to be betting on European growth. Four years after the European Central Bank launched its multi-billion euro monetary stimulus – the region’s inflation expectations are even lower than then.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox