Swiss bank account holders: negative interest rates are here to stay

It was big news when Postfinance, the first Swiss bank categorised as “too-big-to-fail”, announced the introduction of negative interest rates to customers holding deposits of CHF 1 million and above. Many are now asking how long it will take until banks apply this approach to retail savers. I would argue that it may not be too long given the situation for Swiss banks remains challenging.

Part of the Swiss economy depends notably on Europe given important trade links. Because of this, the Swiss National Bank (SNB) is trying to work with the EUR/CHF exchange rate through a combination of negative interest rates and market intervention in the currency market. In the first two weeks after the US election, the SNB’s sight deposits, the most important means of financing for currency purchases and hence an indication of market intervention, have risen by more than CHF 6bn. To put this in context, this is roughly half of the intervention seen in the week before the EUR/CHF peg broke in Jan 2015. The Swiss Franc, known as a safe-haven currency, was seen as a decent place for investors to hedge against Trump’s reflation policy.

It is unlikely that the SNB would raise interest rates before the European Central Bank (ECB) unwinds its quantitative easing programme, given the upward pressure it would put on the Swiss franc. The ECB is expected to keep negative interest rates unchanged and extend its QE programme for at least 6 months at the upcoming December meeting. As a result, the SNB’s monetary policy stance of deeply negative interest rates appears here to stay. I wrote earlier in the year about the delicate situation the Swiss banks find themselves in. The banking sector is suffering under the negative interest rate environment, and major Swiss banks have until recently been reluctant to pass on negative rates to private customers. This is based on fears of eroding some of their deposit base.

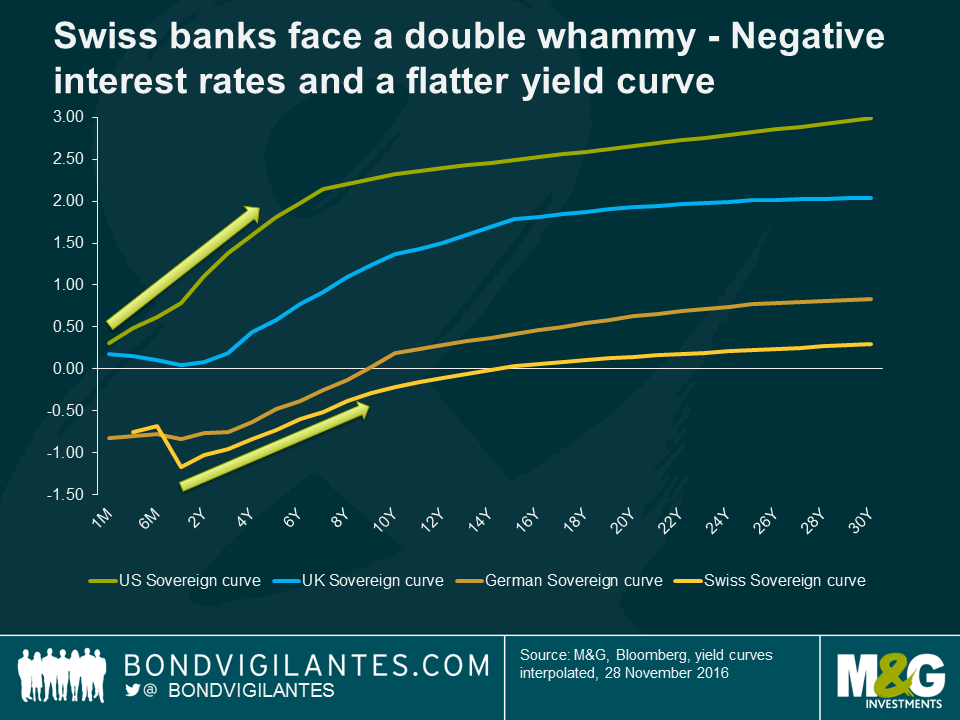

Swiss banks face the additional problem of a flat interest rate curve, which has squeezed the net interest margin from their maturity transformation business. As maturity transformers, banks are notable earners of term premia, and the flat yield curve has caused a further drag on bank profitability. As shown in the chart below, the Swiss yield curve is still relatively flat when compared to UK and US yield curves, even after the recent sell-off in long-dated government bonds. The US and UK government bond curves have thereby been particularly hard hit, given the market’s assumption that the respective governments of both nations are likely to increase debt issuance to finance fiscal spending.

While the Swiss interest rate curve may steepen further due to technical factors like developed market yield differentials, the fundamental economic environment should continue to exert downward pressure on yields. Even though economic growth has been surprisingly robust despite the headwind of an overvalued currency, Swiss real GDP remains below its long-term trend rate. The SNB’s GDP forecast for 2016 is estimated to be approximately 1.5%, and growth is not expected to accelerate by much from here in coming years. The economy is also some way from generating any sort of upward inflationary pressure, and has been in deflation for two years. While a positive headline inflation number is likely to be seen in the months ahead given the increase in oil prices, core inflation remains low which should limit the upside for inflation in the next few years.

Turning to regulatory developments, Swiss banks also face more stringent capital requirements for their risk-weighted assets and tighter leverage ratio rules than their peers around the globe, given the size of some banks that makes them systemically important for the Swiss economy. The more stringent capital requirement rules put in place for Swiss banks have even been given a name in the financial regulatory scene – “Swiss finish”.

Given the above developments, Swiss banks are now forced to find new ways to ensure a profitable business model. We’ve seen already banks passing on negative rates via higher fees and higher borrowing rates, but now that Postfinance has broken the ice by charging deposits of private customers directly, I expect other major banks to follow. Negative interest rates are likely to be the new normal for Swiss bank account holders, at least over the medium term.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox