EM bank strength: Are EM AT1s a safer option than DM?

Is emerging market (EM) bank debt safer than that of developed market (DM) banks? Judging by the performance of high-quality EM bank bonds versus their DM counterparts so far this year, the market certainly seems to think so, particularly when it comes to deeply subordinated Additional Tier 1 capital (AT1) instruments (the key features of which have been discussed here).

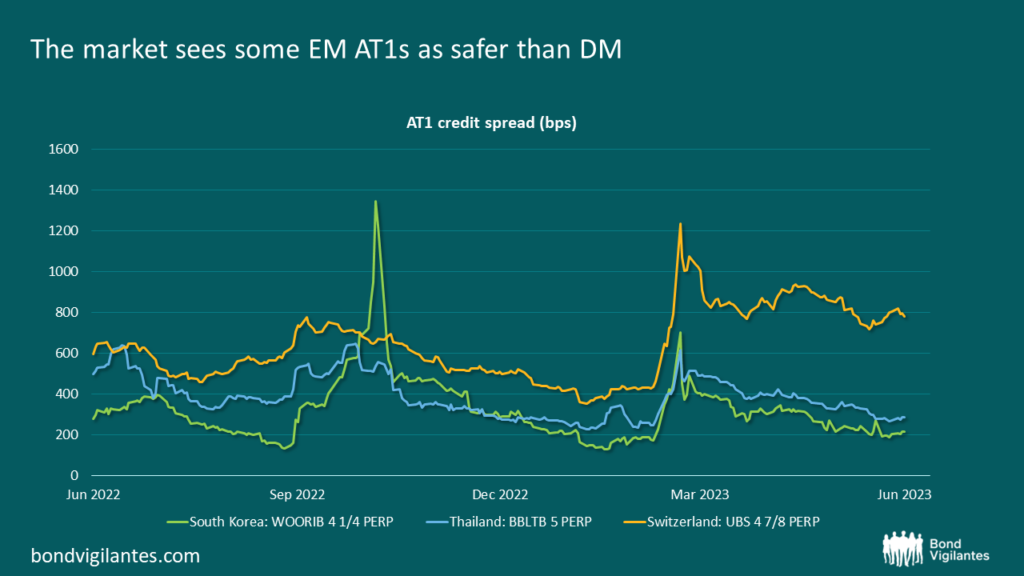

To say that DM banks have had their issues this year would be putting it mildly. The collapse of SVB in the US sparked a panic affecting various US regional banks, which are less intensively regulated than their larger peers (see here). This was followed by the collapse of Credit Suisse, which was resolved by the Swiss authorities brokering its sale to UBS on condition that its stock of AT1 bonds was wiped out. The many issues arising from this decision are not the subject of this article. The important point here is that the CS event sparked a sell-off in AT1 instruments globally, from which high-quality EM assets have recovered more strongly than DM peers (see chart below). Is this justified?

Source: M&G, Bloomberg (30 June 2023)

We agree with the market’s assessment, especially when it comes to high quality names in stable parts of the world. Recent non-calls in LatAm – notably by ITAU and BCOLO (discussed here) – make the case much harder on this continent. But when it comes to the GCC and south-east Asia, the chances of banks experiencing the kind of problems experienced by the US regionals and/or of their AT1s not being called on time are very small.

To start with the US comparison, the stress suffered by regional banks was – to put it simply – caused by deposit outflows that had to be funded by the sale of long-dated Treasuries or MBS, crystallising losses caused by the Fed rate hikes but which had not been marked to market for regulatory capital purposes. This set of circumstances is inconceivable in EM. Debt issuing banks are almost always systemically important, with large granular deposit bases that do not face competition with money-market funds. Liquidity tends to be held at the central bank or held in shorter-dated government securities, and there is no MBS market. Regulation is thorough as these countries are protective of their financial systems and asset holdings are appropriately marked for capital purposes. Additionally, we should note that the traditional cause of bank problems, namely a deterioration in asset quality, has so far been absent both in DM and EM. We therefore see no reason for EM banks to experience DM issues – even CS, though facing a different set of problems to US Regionals, was ultimately brought down by a deposit run rather than bad loans.

Let us now turn to AT1s. The chart shows three AT1 securities from South Korea (WOORIB), Thailand (BBLTB) and UBS (Switzerland). All three banks are domestically systemically important and all three securities have similar ratings. The CS event in March caused AT1s globally to sell off sharply. It is noteworthy not just that these EM bonds have recovered faster than is the case in DM, but also that the DM bond has traded wide of its EM equivalents for at least a year, implying that the markets see less risk in EM AT1s. Again, we agree with this assessment. Western banks – especially in the US – are more likely to call on a strictly economic basis, while governments are under huge political pressure to protect taxpayers if a bank hits the buffers and are therefore likely to enforce bail-in, of which CS is only the most recent example. Things are different in EM, where reputation vis-à-vis the markets trumps economics on calls, governments are supportive of their larger banks and regulators often see calling on time as a matter of financial stability. The stock of AT1 debt is also much smaller, making it less worthwhile to tweak the market’s tail: CS’ $17bn of AT1s alone outweighed the entire LatAm stock of just $12bn.

All this is not to say that AT1s are not risky or volatile instruments: they clearly are. The chart shows the extreme moves experienced by WOORIB’s perps when a Korean life insurer “accidentally” failed to call its subordinated bond in October 2022. This was rectified within days by the regulator on financial stability grounds but it took AT1s in the region some time to recover. Then there are the non-calls we have experienced in LatAm, fear of which is causing lower-coupon bonds in the region to trade at a discount to higher-coupon peers as the economic case for them to be called is less clear, especially as the CS incident has all but closed the AT1 market globally, making refinancing difficult. But LatAm lenders tend to have high yield ratings and the jurisdictions in which they operate are regarded as less reliable than higher-rated countries. The key point is that we believe the risk of bondholders not getting their money back at the first call date – or suffering writedowns if the worst happens – is lower in high quality EM countries than it is in the developed world.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.